Under Armour Overview

Under Armour is a multinational footwear, apparel and sporting goods company headquartered in the United States. Under Armour has a market share of around 4 percent in the US sporting goods market and its main competitors include Nike, Columbia Sportwear, Ralph Laurel and other major sporting brands not only in the US but also in other countries. For competing with industry leaders like Nike, Adidas and Puma, Under Armour needs to develop competitive advantages to acquire a larger share in the sporting goods and sports apparel market.

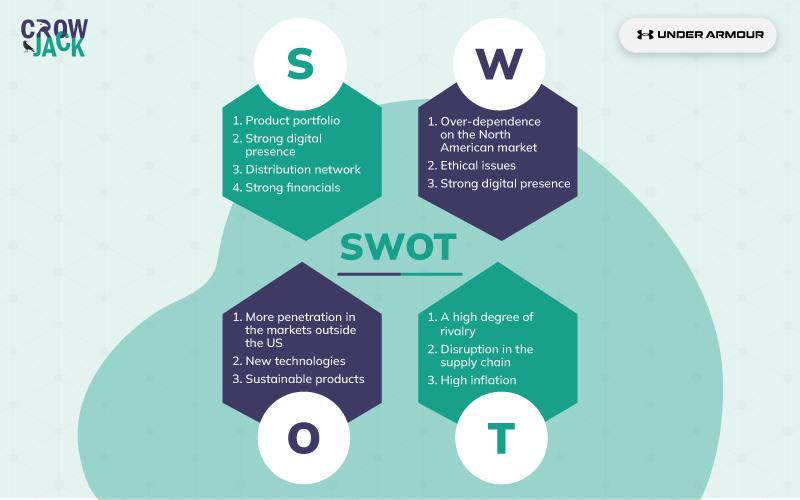

This article presents a detailed SWOT Analysis of Under Armour highlighting the key strengths and weaknesses of the company. Furthermore, the analysis also sheds light on the opportunities and threats for the company in the external business environment. Besides, if you wish to learn about SWOT Analysis in detail, you can go through our extensive SWOT Analysis guide. For now, let us get started with Under Armour’s SWOT analysis.

Table of Contents

An intriguing SWOT analysis of Under Armour

Strengths of Under Armour

Product portfolio- Under Armour has a range of products for all segments including men, women, and kids. Its products include t-shirts, pajamas, vests, underpants, shoes, bags, caps, headphones, socks, belts, sunglasses, sports equipment along with many other products.

Strong digital presence- Under Armour operates a variety of apps in the fitness section as well like MapMyFitness, MyFitnessPal, and Endomondo along with its shopping app called UA store. The UA store app is built to enhance the customer experience wherein the customers are recommended the items based on their preferences. The app has more than 170 million downloads.

Distribution network- Under Armour has different distribution channels for enhancing the sales of its products. The major network comprises of Wholesalers that contribute 53% of the total sales while direct to consumer segment generates 41% of the business. The company also licenses its stores in a few nations like Russia, Slovakia, etc. and this mode constitutes 2% of the total business while 3% of business is from the fitness segment (Under Armour, 2021).

Strong financials- The company’s revenue in 2021 grew by 27% to %5.7 billion and it has a market capitalization of $7.70 billion. There has been an increase in the free cash flow over the last 3 years from $457,845 in 2018 to $595,070. The increasing cash flow is a positive sign as it highlights growth in liquidity that would become useful while tackling the challenges.

Weaknesses of Under Armour

Over-dependence on the North American market- Over 66% of the company’s sales are generated In the North American market. The company needs to expand its markets to sustain itself in the long run and competitive world.

Ethical issues- Under Armour has been involved in various unethical issues like an accounting scandal wherein it altered its revenue and other financial disclosures during 2017-2019 (Kimbal & Thomas, 2019). It has been ranked low in adhering to the UN’s sustainable development goals. Further, many of its Malaysian suppliers have been accused of employing forced labor to manufacture the products. The company should adhere to ethics in its stores and ensure the ethics are followed in its supply chain as well. The company needs to address ethical issues in workplace with a sense of urgency.

Opportunities for Under Armour

More penetration in the markets outside the US- Under Armour can penetrate more into the markets where it has limited presence like China, India, and other emerging markets. The Indian market has huge potential as the athletic footwear market is predicted to grow by 10% from 2022-to 2026 whereas the apparel market will grow by more than 16% by 2026.

New technologies- Under Armour can ease the customer shopping experience by installing various technologies in its stores that include cash and cardless payment systems wherein the payment could be deducted directly from the app through facial recognition in the stores. This would lessen the shopping time of the customers as they would not have to wait in queues.

Sustainable products- Under Armour can contribute more to environmental sustainability by manufacturing shoes from recycled plastic. Nike has started using recycled plastic, polyester, and foam in its shoes (Danigelis, 2020). This would create a circular economy and ensure less dumping of plastic into landfills and hence would lead to a reduction in environmental pollution.

Threats of Under Armour

A high degree of rivalry- Under Armour has intense competitors that include Adidas, Nike, and many others. Nike is the biggest competitor as it controls 39% of the global athletic footwear and 13% of global athletic apparel (Salpini, 2021). Adidas is also a major threat as it is valued high at $16.5 billion and is the fourth largest apparel brand in the world. The competition would force the company to reduce the prices of the products in order to gain an advantage, this can impact the profitability of the company.

Disruption in the supply chain- The shortage of cotton and other petroleum-based products along with the consistent fluctuation in their prices because of COVID can have an impact on the operations of the company. For managing these disruptions, the company needs to come up with effective change management strategies.

High inflation- The record 7.5% current inflation in the US and high future projections would result in high prices for the raw materials which would ultimately impact the prices of the final products. This can result in a reduction in sales.

To encapsulate, Under Armour can benefit a lot in the market as it has strong financials and registered positive growth in terms of revenue and free cash flow. The increase in cash flow indicates that inflows are more than the outflows, meaning that the liquidity is increasing and the company could use that while dealing with negative environmental situations. The company also has a diversified portfolio of products and this can act as an advantage as the customers can get all the items under one roof and the company uses different distribution techniques which makes it easy for it to target different markets and segments. Under Armour needs to be more ethical as the company has been involved in various financial misdeeds. Its suppliers have also faced criticism for not adhering to the government regulations related to employment. The company can enhance its image by being more sustainable and for that, it can use more recycled products to manufacture the shoes. Furthermore, if you want to understand how external industrial influences impact Under Armour, you should go through our extensive PESTLE Analysis of Under Armour.

Recommended Readings

References

DANIGELIS, A. (2020). Nike Launches Footwear Collection Made from Post-Consumer Waste. Retrieved 13 April 2022, from https://www.environmentalleader.com/2020/06/nike-post-consumer-waste-footwear/

Goswami, K. (2021). With An Epic Low Of 9 Points, Under Armour Has UN's SDGs Butchered, But It's Dusting Itself Up. Retrieved 13 April 2022, from https://www.colourfulingrey.com/post/with-an-epic-low-of-9-points-under-armour-has-un-s-sdgs-butchered-but-it-s-dusting-itself-up

Kimball, S., & Thomas, L. (2019). Under Armour faces federal investigation over its accounting practices. Retrieved 13 April 2022, from https://www.cnbc.com/2019/11/03/under-armour-is-the-subject-of-a-federal-accounting-probe-wsj-reports.html

Salpini, C. (2020). Nike is on track to make $50 billion this year. How much is that, really?. Retrieved 13 April 2022, from https://www.retaildive.com/news/nike-is-on-track-to-make-50-billion-this-year-how-much-is-that-really/608511/

Tode, C. Under Armour taps 170M fitness users for new shopping app. Retrieved 13 April 2022, from https://www.retaildive.com/ex/mobilecommercedaily/under-armour-taps-170m-fitness-users-for-new-shopping-app

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register