Afterpay Overview

Afterpay is a budding company in Australia dealing in Buy Now Pay Later services and has expanded its reach to many markets including the US, UK, Canada, and New Zealand. The company has a strong network of more than 100,000 merchants from whom the customers can purchase the products on easy terms and conditions.

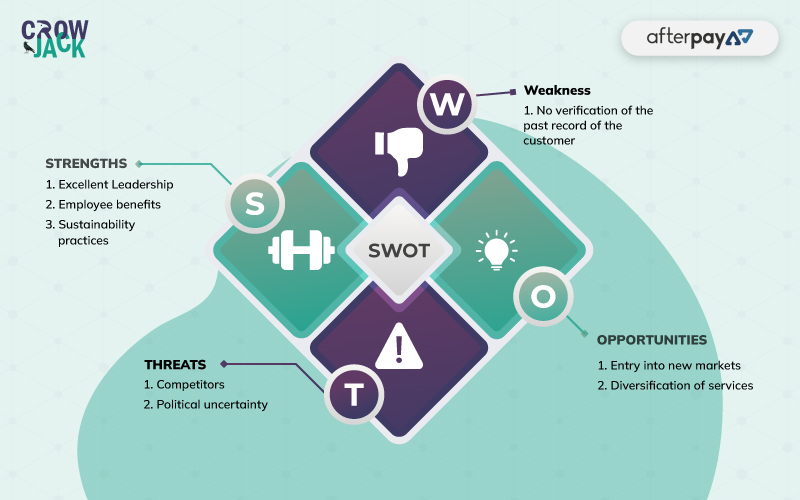

This article presents a detailed SWOT Analysis of the company as a fine example of Small Business SWOT analysis. The article takes into account the internal strengths and weaknesses of the company while also delving into the opportunities and threats in the external environment of the company. Besides, if you wish to learn about SWOT Analysis in detail, you can go through our meticulous SWOT analysis guide. For now, let us get started with the SWOT analysis of Afterpay.

Table of Contents

A Delineated and Meticulous SWOT Analysis of Afterpay

Strengths of Afterpay

Excellent Leadership- Afterpay has a team of leaders that are immensely experienced and have contributed a lot to the growth of the company. Elena Rubin is the current chairman of Afterpay and director of Telstra and Slater & Gordon and various authorities of the Victorian government. She has served as a director of Mirvac and was formerly chairman of Australian Super and WorkSafe Victoria.

She has also been associated with various insurance, infrastructure, and financial sector companies and currently, she is a member of various social organizations. The vast experience of the Chairman has helped the company achieve great heights and it has been able to partner with 100,000 merchants and more than 11 million customers in just a short period of time under her guidance hence she can guide the company better in social works and legal frameworks because of her past experience.

Further, Anthony is the CEO and MD and had been involved with a number of financial services, investment firms, and software and technology companies during his 25 years of corporate experience (Afterpay, 2021). The leadership capabilities of the company have helped the company achieve great success in little time.

Employee benefits- The employees in the organization are offered various facilities like free-of-cost vision, dental insurance, and the option to purchase stocks of the company along with many other benefits. These help in boosting the employee morale and the company would be able to retain them for a long time.

Sustainability practices- Afterpay has tied up with several NPOs that promote child development and work for a clean environment. Further, the company has itself launched an initiative of showcasing the live shopping experience of customers from the companies that offer eco-friendly products.

Weaknesses of Afterpay

No verification of the past record of the customer- Afterpay does not indulge in credit checks and does not ask for any past financial information about the customer which means that customers with the lowest credit scores or who do not have the intention to pay back can also avail the loan facility and this can pose a serious challenge on the financial health of the company if the loan is not repaid.

Opportunities for Afterpay

Entry into new markets- Afterpay can enter into emerging markets like India where the Buy Now Pay Later is expected to increase by ten times from $4 billion to $45-$50 billion by 2026 (Anand & Phartiyal, 2021).

Diversification of services- Afterpay can expand its operations by launching its own e-wallet and physical cards. For that, the company will need to embrace effective change management.

Threats for Afterpay

Competitors- Afterpay faces intense competition from the other existing players like Zippay, Humm, etc. Humm has a customer base in millions along with strong financial ability generating yearly revenue of about $400 million. Further, the revenue of Zippay has increased by 4 times in the last 2 years (Intelligent investor, 2021)

Political uncertainty- The governments all around the globe like Australia, Canada and US where Afterpay has a significant presence are tightening the norms on the Buy Now Pay Later companies by limiting the customers that can avail of credit and other regulations.

Hence, it can be said that the experienced leadership and sustainable practices by the company can be beneficial in terms of scaling the business and improving the image among the customers. However, the competitors can pose a great threat for which Afterpay can diversify its offerings which would enable it to enhance its customer base and market share. Besides, if you want to understand the impact of external factors on the company, you can read our insightful PESTLE analysis of Afterpay. Also, you can read the PESTLE Analysis of Afterpay to determine how the macroenvironment factors influence the company or the automotive industry.

Recommended Readings

References

Anand, N., & Phartiyal, S. (2021). Buy now, pay later business set to surge over ten-fold in India. Retrieved 9 June 2022, from https://www.livemint.com/industry/banking/buy-now-pay-later-business-set-to-surge-over-ten-fold-in-india-11636370182746.html

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register