Citibank Overview

Citibank is among the top 5 banks in the US and has a significant international presence with operations in more than 160 countries and 200 million customers. The services provided by the bank include investment banking, advisory and transaction services, capital markets, risk management, and retail banking. The major competitors of the bank include Wells Fargo, Goldman Sachs, Bank of America, JPMorgan Chase & Co, and CIT Group.

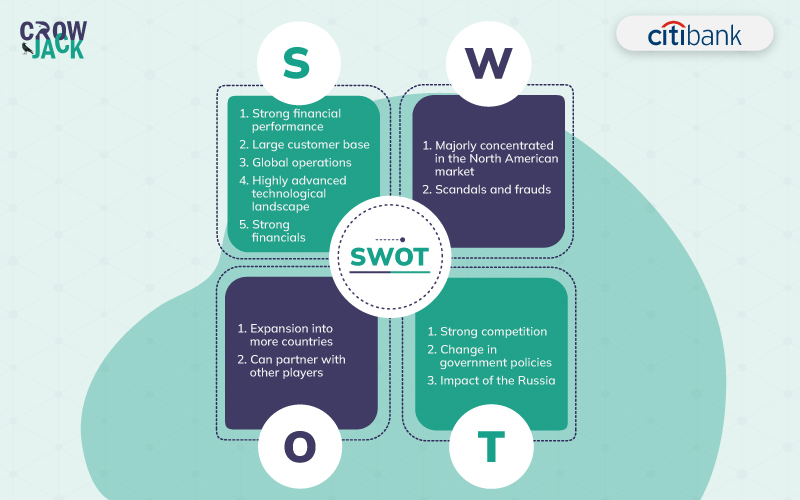

This article presents an exclusive and detailed analysis of Citibank delving into the internal strengths and weaknesses of the company. Also, the article looks into the opportunities and threats available to Citibank in the external environment of the global banking industry. Besides, you can check out our detailed SWOT Analysis Guide to learn about the strategic model in detail.

Table of Contents

A Scrupulous Elaboration of SWOT Analysis of Citibank

Strengths of Citibank

Strong financial performance- The data in the latest annual report reveals that Citibank is financially very strong and it is evident from the fact that the company’s net income is rising significantly and the income has risen by 98% to $21.95 billion in 2021 from $11.04 billion in 2020. Further, there has been an increase in the earnings per share as well, it increased from $4.72 in 2020 to $10.14 in 2021.

Large customer base- Citibank is into personal banking and retail services as well. It has 128 million customers for personal banking that transact around $503 billion. Further, Citibank serves around 74 million retail customers worldwide and a few of the prestigious ones include Best Buy, Exxon, Mobil, L.L. Bean, Macy's, Sears, Shell, the Home Depot, Tractor Supply Company, and Wayfair (Citibank, 2022).

Global operations- Citibank’s operations are spread across the globe with a presence in all regions including Asia Pacific, Europe, Middle East, Africa, and Latin and North America. The countries where it has a strong presence include the US, India, Canada, the UK, etc. Further, the company has more than 20,000 ATMs and 4000 branches.

Highly advanced technological landscape- Citibank promotes innovation in the workplace on a large scale and has been constantly ranked among the Top 50 Best Workplaces for Innovators by various agencies. Further, the company is experimenting with the card-less entry system into ATMs wherein the customer would receive a push notification on the smartphones and smartwatches whenever he is near the ATM branch and then the devices can be transformed into virtual keys which can be used to unlock the door after the operating hours. Likewise, many other new technologies are being implemented for the convenience of the customers (Samuely, n.d.).

Weaknesses of Citibank

Majorly concentrated in the North American market- Almost 50% of the group’s revenues are generated in the North American market (Citibank, 2020). Such a large dependence on one market can prove to be costly if the market witnesses any economic downturn.

Scandals and frauds- Citibank has been involved in many scandals and other irregularities over the years. In one instance, the banker in the company sent $1billion to the wrong people and as a result, the company was fined $400 million by the regulators alleging that the company is not taking appropriate steps to stop money laundering (Flitter, 2021). These types of ethical issues must be stopped to ensure no loss of reputation among the stakeholders.

Opportunities for Citibank

Expansion into more countries- As the group’s major revenue is derived from one market, it should expand into other major markets like that Asia and Africa so as to have profit

Can partner with other players- Citibank can partner with emerging fintech startups or acquire them to widen the range of its services. For that, the company needs to rely on a well-laid-down change management strategy.

Threats for Citibank

Strong competition- Citibank faces intense competition from various established banks like Bank of America, HSBC Bank, Wells Fargo, Goldman Sachs, etc. The Bank of America has around 67 million customers and 4,100 retail financial centers along with 16, 000 ATMs (Bank of America, 2022). Further, Goldman Sachs is an expert in investment banking, asset management, and the consumer and wealth management segment. As per the group’s annual report, the numbers include more than 3 million total customers, $36 billion in consumer deposits in the U.S. and the U.K., and nearly $5 billion of consumer loans (Goldman Sachs, 2022).

Change in government policies- Citibank has an alliance with MasterCard and most issues are the cards made by MasterCard. The recent ban of the Indian government on MasterCard means that Citibank’s retail operations would have to make a considerable change and this decision has resulted in the company putting its retail business on sale (Rebello, 2021).

Impact of the Russia- Ukraine war The ongoing war between Russia-Ukraine has resulted in a loss of $3 billion to the company now because of the closure of operations.

To encapsulate, Citibank has a large financial power that it can use to expand its operations in various emerging economies where it has little or no presence. Citibank has a strong competitive rivalry which can be mitigated by tying up with various Fintech startups which would enable the company to diversify its product segment and integrate more technology into business operations. Also, you can read the PESTLE Analysis of Citibank to determine how the macroenvironment factors influence the company or the automotive industry.

Recommended Readings

References

Bank of America. (2022). Bank of America. Retrieved 9 June 2022, from https://newsroom.bankofamerica.com/companyoverview#:~:text=The%20company%20provides%20unmatched%20convenience,54%20million%20verified%20digital%20users.

Flitter, E. (2021). Citigroup is fined $400 million over ‘longstanding’ internal problems.. www.nytimes.com. Retrieved 23 May 2022, from https://www.nytimes.com/2020/10/07/business/citigroup-fine-risk-management.html.

Rebello, J. (2021). RBI’s Mastercard ban may hit Citibank India’s retail business sale Read more at: https://economictimes.indiatimes.com/industry/banking/finance/banking/rbis-mastercard-ban-may-hit-citibank-indias-retail-biz-sale/articleshow/84533194.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst. Retrieved 9 June 2022, from https://economictimes.indiatimes.com/industry/banking/finance/banking/rbis-mastercard-ban-may-hit-citibank-indias-retail-biz-sale/articleshow/84533194.cms

Samuely, A. Citibank commits to beacons after merchants give the technology a thumbs-up. Retrieved 9 June 2022, from https://www.retaildive.com/ex/mobilecommercedaily/citibank-commits-to-beacons-after-merchants-give-the-technology-a-thumbs-up

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register