Citibank Overview

Citibank is a world-renowned bank headquartered in the US and provides a range of services including investment banking, advisory and transaction services, capital markets, risk management, and retail banking. The company has been in existence since 1812 and has a market capitalization of more than $99 billion. The company earned revenue of $71.9 billion in 2021 and earned a net income of $22 billion. The earnings per share in 2021 were also in double digits at $10.14.

PESTLE analysis is one of the important tools to analyze the external environment that can impact the industry. This article would analyze the impact of the political, economic, social, technological, legal as well as environmental factors that can have an impact on Citibank. The PESTLE analysis would prove to be beneficial for the company to formulate strategies for efficient operations in the US as well as India. Besides, if you wish to learn about the PESTLE model in detail, you can go through our comprehensive PESTLE Analysis Guide.

Table of Contents

An intelligible PESTLE Analysis of Citibank

Political factors affecting Citibank

The federal government of the US has recently announced a reduction in corporate tax from 35% to 21% to boost investments. The companies operating internationally can benefit from the tax treaty that the US has with 85 countries under which the income earned in a few nations by the US companies is taxed at a lower rate while earnings from many countries are tax-free (IRS, 2022).

Besides, the Indian government is planning to amend the Banking Regulations Act which would restrict the new bank license holders from conducting specified business activities which would ultimately limit their freedom and more control for deciding on the operations of the banking companies would go to the Reserve Bank of India (Tiwari, 2021).

Economic factors affecting Citibank

The main economic parameter that impacts the banking industry is the interest rate and strong fluctuation that can have an impact on the burrowing power of the bank’s customers. As far as the US is concerned, Federal Reserve has hiked the rate by 50 basis points which is the biggest hike since 2000 and further the central bank has plans to hike the rate further in the future. This would hike the rate of installments for the customers and hence they would lessen buying from the banks which would ultimately impact the revenues of the banks.

Besides, the Reserve Bank of India recently raised the repo rate by 40 basis points and this decision could impact the money burrowing capacity of the banks from the central banks (Adhikari, 2022). The move would make burrowing of loans more expensive.

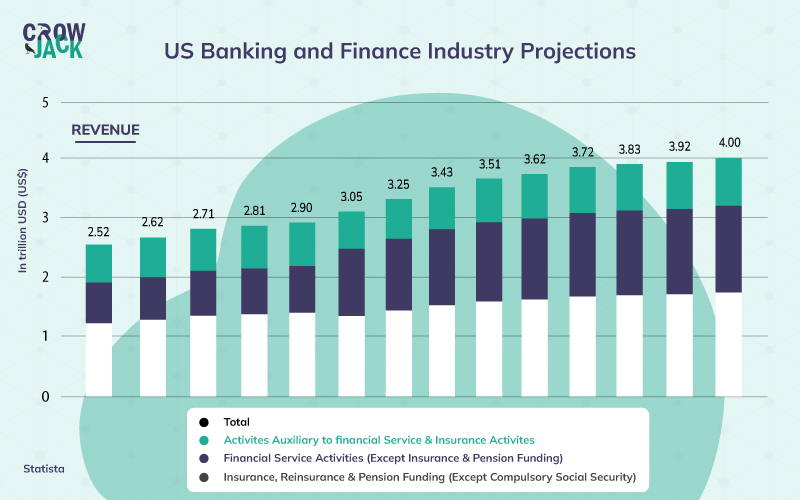

The banking industry in the US is currently worth high and as per Statista, the US banks have combined assets worth $27.7 trillion. The largest banks in the country include JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Goldman Sachs. Commercial Banking in the US is expected to rise at a faster pace, at a CAGR of 6.5% till 2027 while retail banking is predicted to grow by 4.49% till 2026.

Social factors affecting Citibank

The trend of digital banking has grown after COVID and the segments that have grown the most after COVID in the US according to McKinsey are digital investment and lending with the growth of 23% and 25% respectively.

Further, the surprising aspect is that the baby boomers constitute the most, around 26% of the shift in banking from traditional means to Fintech. This signifies the need for the banking companies to highly shift all their operations to digital mode.

Moreover, in India, the concept of the green banking is on the rise and more and more people are preferring to use sustainable banking services that are favorable to the environment

Technological factors affecting Citibank

The US government spends the highest on Research and Development in the world. It spent $157 billion in 2021 and the expenditure for 2022 is estimated to be $171 billion while the government of India spent Rs. 851 crore in 2021 and the budget has been decreased to Rs. 812 crore for 2022. The technologies that are revolutionizing the banking industry include more use of digital approaches wherein the concept of neo banking has emerged and is gaining importance.

Neo banking involves 100% digitization and there is no physical branch and all the services such as digital and mobile-first services like payments, debit cards, money transfers, lending, etc. through digital means. For integrating these technologies effectively, the companies will have to make sure that they take the right approach to change management.

Both the banks and the customers can benefit from this technology as the banks are able to save on the cost of establishing physical infrastructure and the digital operations enable the companies to better analyze the data and enhance the level of their services while the customers would get every service sitting in their own premises (Business Standard, 2022).

Further, the use of cloud software for storing and accessing the data can be really helpful for the banking companies as it can help them in saving costs of establishing data centers and procuring physical servers for storing the data (Srivastava, 2022).

In addition, businesses nowadays are focusing a lot on customer service and the use of AI chatbots for interacting with the customers can eliminate the need for human resources, and also the companies can respond to the queries 24*7. This can lead to an increase in the level of customer service. For greater scalability, the banking industry needs to incorporate the incredible benefits of AI in business.

Moreover, the security in the banks is now being enhanced with the implementation of a zero-trust security model wherein every stakeholder, be it internal or external to the organization is authenticated and continuously validated for security configuration and posture before being granted or keeping access to applications and data.

Legal factors affecting Citibank

The banking industry in the US is regulated by the Office of the Comptroller of the Currency. The Comptroller of the Currency has recently formulated the Fair Access to Financial Services rule wherein the banks now cannot refuse to serve customers that they find to be politically or morally unethical like cryptocurrency projects, marijuana businesses, sex worker advocacy groups, and others (Belcher, 2021).

Further, banks operating in the US are required to maintain detailed records of all transactions and file reports regarding all transactions, currency exchanges, and certain monetary instruments' transportation of more than $10,000. This is being done to minimize the chances of money laundering.

The banking industry in India is regulated by the Reserve Bank of India. The RBI is the central bank and is responsible for formulating pan-India monetary policy, bank supervision and regulation, foreign exchange control management, oversight of the payments system, and development of the financial markets.

Further, the banks in India also have to abide by the Banking Regulation Act and the recent amendment in the act provides more authority to the Reserve Bank of India to remove the Chairman of any bank if he is not deemed fit and appoint a suitable person if the bank does not do so.

Further, RBI is empowered to issue an order to supersede the Board of Directors of multi-state co-operative banks for a maximum period of five years and appoint an Administrator. Hence, this limits the freedom of the banks to operate freely.

Environmental factors affecting Citibank

The top 18 banks in the US contribute about 1968 billion tons of carbon dioxide and the emissions from the loans are 700 times more than the running of offices. Further, the banks also contribute to pollution by financing projects that are related to fossil fuels. The newly passed Fossil Free Finance Act restricts the banks from financing the projects that emit greenhouse gas emissions.

The legislation specifically mandates that all bank holding companies with more than $50 billion in assets and all nonbank SIFIs reduce financed emissions by 50 percent by 2030 and 100 percent by 2050. This means that banks would have to shift to other green practices for conducting operations which may cause a temporary decline in the customer base and also the companies might need to incur additional expenditures to modernize the infrastructure.

To conclude, the banking industry in India can face issues in autonomy as the government has provided more powers to the central banks with respect to deciding on the operations, approval, removal of chairman, etc. The rise in interest rates by both the US and India to control the inflation can make lending more costly for the customers which may lead to a decline in the business of the banks. Besides, if you want to analyze the internal strengths and weaknesses of the company, you can go through our meticulous SWOT Analysis of Citibank.

Recommended Readings

References

Adhikari, A. (2022). How US Federal Reserve’s 50-bps rate hike is likely to impact Indian financial markets. Retrieved 9 June 2022, from https://www.businesstoday.in/latest/economy/story/how-us-federal-reserves-50-bps-rate-hike-is-likely-to-impact-indian-financial-markets-332364-2022-05-05

BELCHER, M. (2021). New OCC Rule Is a Win in the Fight Against Financial Censorship. Retrieved 9 June 2022, from https://www.eff.org/deeplinks/2021/01/new-occ-rule-win-fight-against-financial-censorship

Srivastava, S. (2022). Cloud computing in banking: All you need to know before moving to the cloud. Retrieved 9 June 2022, from https://appinventiv.com/blog/cloud-computing-service-for-banking/

Tiwari, D. (2021). Changes in Banking Regulation Act in works. Retrieved 9 June 2022, from https://economictimes.indiatimes.com/industry/banking/finance/banking/changes-in-banking-regulation-act-in-works/articleshow/88040598.cms

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register