Walmart Overview

Walmart, the globally renowned American retail brand is the biggest brick-and-mortar retailer in the world. With more than 10,500 stores across the globe, it has developed its enormous authority as a trusted and omnipresent retail brand. However, the majority of its operations cater to the US market wherein it has more than 4300 stores (Walmart, 2022). Financially, Walmart has a strong and consolidated position which is one of the competitive advantages the company has. To validate, the company generated massive sales worth $559 billion in 2021. Speaking of its human resources, the company has more than 2.3 million employees and associates across the globe as per the corporate information provided by the company.

Walmart’s mission is to help people around the world save money and live better – anytime and anywhere – in retail stores and through e-commerce. The company is fulfilling its mission by providing the lowest priced products across every department in its stores to people across the globe.

For the external analysis of Walmart, the PESTLE analysis model will serve as an effective tool for analyzing the external environment with respect to the industry. It reveals the political, economic, social, technological, environmental, and legal aspects prevalent in the countries. This article would contain an in-depth analysis of the prevailing political, economic, social, technological, environmental, and legal environment for the retail industry in the US as well as China.

Table of Contents

An enticing PESTLE analysis of Walmart

Political factors affecting Walmart

The trade and commerce environment in the US is robust and is well supported by the Joe Biden government. Also, the government has announced various relief packages to help industries revive from the losses brought by the COVID-19 pandemic. The state of New York is planning to introduce a law wherein the companies that have revenues of more than $100 million are required to disclose their material production volumes and also reveal to the government the suppliers that the companies believe cause greater risk to the environment or the society in terms of not providing employees with fair wages, releasing more than mandated greenhouse gas emissions.

This is being done to hold increase transparency and hold companies accountable for unethical and unsustainable operations (Green, 2022). However, the present state of US-China relations and the sanctions imposed by the US on Russia will have negative repercussions on the US retail companies looking to expand beyond the US.

Further, China one of the emerging markets is expected to boost with the government’s assistance to the customers wherein the government is offering free coupons to the people that can be redeemed for dining, shopping, and traveling purposes. But the trade rift between US and China may imply adverse situations for US retailers planning expansion in China. This may cause a shift in expansion strategies subject to an effective change management process.

Economic factors affecting Walmart

The high inflation rate of 7.5% in the United States can be worrisome for the retail companies that deal in affordable products as their target market is usually the people with low to middle income and inflation would impact the prices which can ultimately impact the sales of the products. High inflation could potentially result in a downfall in demand and hence, have a negative impact on the industry. However, as per Statista, the per capita income of Americans is expected to rise consistently in the coming years. Having said that, more citizens will be interested in purchasing from supermarkets and there will be a rise in the purchase of essential as well as luxury goods.

Besides, the Chinese economy registered a huge growth of 8.1% in 2021 but it is expected to fall to 5.1% in 2022 and thereafter remain flat in 2023. In addition, the GDP per capita in China is expected to rise by a significant margin from $12,551 in 2021 to $25,307 in 2025. This would also lead to an increase in consumption, signifying a positive scope for the retailers.

The US retail market is anticipated to jump to $5.35 trillion in 2025 from $4.85 trillion in 2021 and e-commerce sales increased by more than 14% in 2021 (Young, 2021).

Social factors affecting Walmart

The pattern of shopping among American customers is witnessing change after the COVID pandemic. More than 35% of customers are preferring to shop online for essential products such as medicine, groceries, household supplies, and personal care products (Charm &Coggins, 2021). Further, the online grocery market is expected to constitute 20% of the total grocery sales in the US by 2026, highlighting the need for companies to aggressively invest in online platforms (Redman, 2021).

Also, there is keen interest among shoppers now to buy products of premium brands to embrace a modern lifestyle. This will lead to an upward trend in the revenue of the retail industry. Besides, consumers are now more attracted to having more choices in consumer goods and essential items.

Furthermore, the trend of purchasing from supermarkets is rising in China with sales witnessing a rise of 43% in 2021. The reason for making a shift towards supermarkets is the great convenience it offers in shopping experiences. To explain, with great ease people can purchase everything from groceries to appliances to medicines under one roof. Moreover, the level of consumerism is rising in China at a very rapid pace and the consumption level is expected to rise to $5 trillion by 2030, signifying a huge opportunity for the retail segment to augment profits (Woetzel & Seong, 2021).

Technological factors affecting Walmart

Both the US and China have robust technological infrastructures and are global leaders in research and development. The US government spends the highest on Research and Development in the world. It spent $157 billion in 2021 and the expenditure for 2022 is estimated to be $171 billion while the Chinese government also contributes a lot to innovation and in 2021 it spent around 2 trillion yuan.

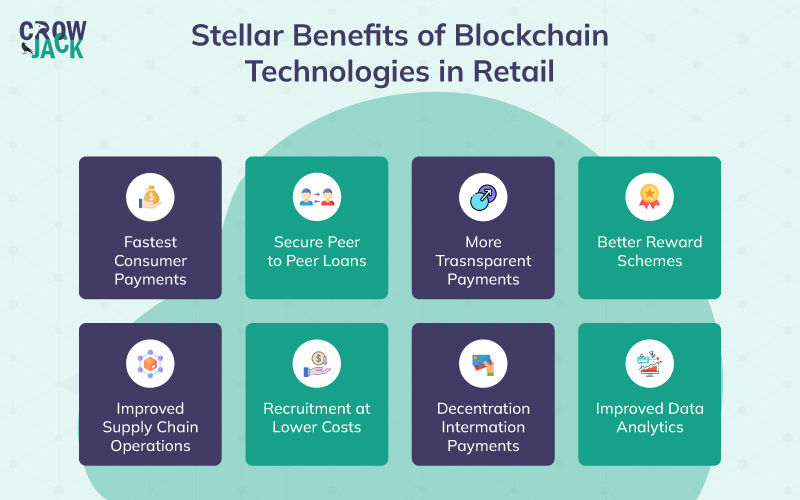

Further, the retail industry is witnessing a shift towards more tech-oriented operations. The use of blockchain for analyzing real-time inventory data helps reduce the inefficiencies in the supply chain and maintain an adequate level of products is on the rise. Further, blockchain is also useful for tracking the sell-by-dates and the retailer can get to know what products should be discounted more. The graphic below elucidates the key advantages of blockchain technology for the retail industry.

This helps in the reduction of wastage. In addition, the use of in-house robots for storing products or providing customer service is also gaining momentum along with a Scan & go technology wherein the stores are totally cashier-less and every step is tech-oriented ranging from scanning the customers while they enter through facial recognition, tracking their purchasing behavior through cameras and installation of sensors on shopping carts eases the customer experience.

Contactless deliveries and deliveries directly to the car are other emerging technologies in the industry. For retailers, exploiting the scope of technology will be a great opportunity to build competitive advantages over competitors. This is where effective change management models become so crucial for the successful implementation of these emerging technologies.

Legal factors affecting Walmart

In the US, there are strong anti-trust and anti-competitive laws in place that prevent large industry players from assuming monopolistic control. Moreover, the retailers that source their products from China might face difficulties as the federal government of the US has amended the Tariff Act, and now it is mandatory for the retailers to disclose the origin of articles that come from China. This is being done to ensure that the products made in Xinxiang through forced labor are not sold in the US. Further, the state of California has recently amended Consumer Protection Act wherein personal information has been subdivided into a category called sensitive personal information.

The information herein relates to sexual orientation, racial origin, religious beliefs, etc. and the companies cannot force the customers to divulge the information contained under the sensitive personal information category. Further, the customers have been entitled to know about the decisions for which the information would be used and what would be the outcome of that decision (Guillot, 2021). These developments can have significant impacts on the industry.

Besides, China is an emerging market for retailers and the government of China has constituted a new data privacy law wherein the companies should store the collected data from the customers in the servers in China itself and the companies are not allowed to transfer the data in other countries without obtaining permission from the regulator. This can create a hindrance in the formulation of effective strategies to enhance the customer experience.

Moreover, China’s Anti-Monopoly law prevents companies from acting with monopolistic discretion and the companies operating in China must comply with it at all times. Also, as per Reuters, the Chinese government is further deliberating on bringing stricter anti-trust regulations in the near future.

Environment factors affecting Walmart

The retail industry is responsible for largescale carbon emissions from their operations through excessive use of energy and use of plastic for packaging and carry bags along with dumping solid wastes in landfills. Various state governments in the US such as New Mexico and Oregon have banned the use of single-use plastic bags less than 2.25mm in thickness. This means that the companies would have to search for new suppliers of bags. Further, the federal government of the US has announced a national recycling strategy wherein companies are required to recycle the waste rather than dispose of it (Shewmake, 2021).

Furthermore, in 2021, China enforced a strict ban on plastic shopping bags all over the country. Besides, China has also announced its target of being a zero-emission country by 2060. The Chinese authorities are keen on bringing stricter environmental norms in place for the industries to stay on track with its ambitious net-zero targets.

To encapsulate, the retail companies would need to be cautious as they are required to furnish details about their supply chain which means that they would be accountable for inaccuracies in their supplier’s operations as well. The high inflation rate in the US can be challenging for low-cost retailers as they would have to rethink their strategies. Further, the rise in consumerism in China and the increase in shopping trends among customers in the US is a potential opportunity for retail companies to expand their business.

And, they can implement technologies like cashier-less facilities to ease the customer experience. But the companies would have to be careful as they pollute the environment in many ways and the governments are getting more aware and continuously changing the regulations to reduce the negative business impact on the climate.

Furthermore, to analyze the strengths and weaknesses of Walmart that determine how well the company can deal with threats and opportunities recognized by this PESTLE analysis, you should definitely read our systematically conducted SWOT Analysis of Walmart.

Recommended Readings

References

Charm, T., & Coggins,, B. (2021). The great consumer shift: Ten charts that show how US shopping behavior is changing. www.mckinsey.com. Retrieved 30 March 2022, from https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/the-great-consumer-shift-ten-charts-that-show-how-us-shopping-behavior-is-changing

Woetzel, J., & Seong, J. (2021). China’s consumption story steadily evolving. /www.mckinsey.com. Retrieved 30 March 2022, from https://www.mckinsey.com/mgi/overview/in-the-news/chinas-consumption-story-steadily-evolving.

Young, J. (2022). US ecommerce grows 14.2% in 2021. /www.digitalcommerce360.com. Retrieved 30 March 2022, from https://www.digitalcommerce360.com/article/us-ecommerce-sales/.

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register