Tesco Overview

Tesco is a well-renowned British grocery retailer with a widespread global presence and a market capitalization of $ 30.6 billion ("Tesco (TSCDF) - Market capitalization", 2022). Given the fact the external environment with respect to the global retail industry is changing at a brisk pace, a comprehensive PESTLE analysis of Tesco will help in determining the impact of external determinants on the global grocery retailing market and hence Tesco.

Table of Contents

Having said that, this article presents a holistic analysis of the external factors affecting the global grocery retailing industry keeping customer acquisition in view. Furthermore, an in-depth understanding of PESTLE Analysis will give you a detailed overview of the most important factors in the macro business environment that directly or indirectly impact the operations and growth prospects of a company in a specific industry. As for now, let us get started with the PESTLE Analysis of Tesco.

Tesco PESTLE Analysis underlining key determinants

Political factors affecting Tesco

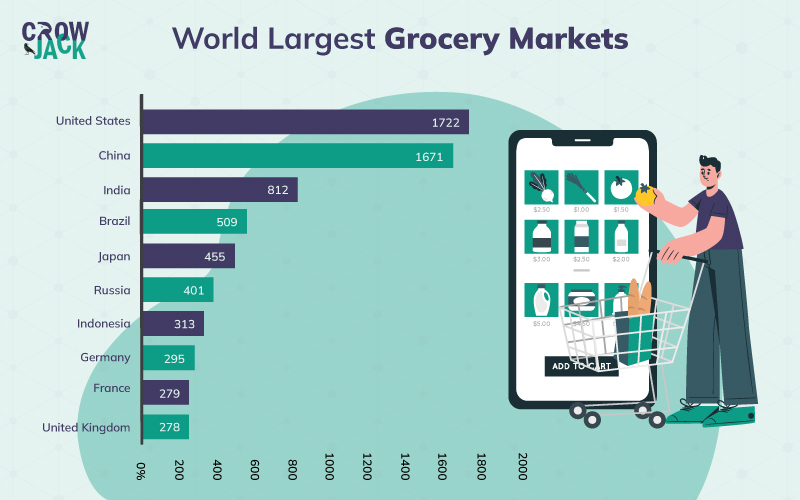

The global geopolitical situation is negatively affected by two prominent developments that include Brexit and the US-China trade war that has severely dented global scenarios. With India, China, and Brazil being the fastest emerging markets with high populations, retailers in the UK and USA see these countries as great opportunities to expand their business and enhance their customer base. However, with a large number of trade tariffs between the US-China, retailers are negatively affected. Also, the aftermath of Brexit has worsened the supply chain problems for retailers in the United Kingdom.

However, in 2021, the UK government announced a massive relief scheme for the retail industry that will provide relief up to £110, 000 per business in the fiscal year 2022-2023. This will be a huge boost for the industry to revive from the impacts of COVID-19 and the supply chain disruptions. Further, in the context of US-China trade disputes, the Joe Biden government is likely to revoke tariffs imposed by the Trump Administration which will be a positive development for the industry.

To add, with respect to emerging markets like India, the FDI regulations and single window clearance mechanism directly concern the industry. In India, the policy on FDI allows 100 percent FDI on e-commerce (B2C) in single-brand retail, however, FDI in B2C e-commerce in multi-brand retail is now permitted(E-commerce is the latest target in India's push for an open digital economy, 2022). Overall, India is committed to promoting an open digital economy is offering large incentives to e-commerce. Also, a National Single Window System is a digital platform that makes it easier for investors to seek approvals and seek guidance.

Economic factors affecting Tesco

Although the global economy is recovering from the economic impacts of COVID-19, there is still some destabilization in the global economic scenario. As per the International Monetary Fund, the global economy is projected to grow at 4.4 percent against 5.9 percent growth in 2022. Unexpected rises in the price of energy and global disruptions in supply chain operations have pushed up the inflation rate higher than expected. The global economy is impacted by economic slowdowns in the USA and China which largely influence the global economic environment being the largest economies. However, to a certain extent, the hike in the inflation rate is good for industries and GDP growth.

But, beyond a certain level of inflation growth, negative impacts will begin to creep in as demand and purchasing power will decrease. Furthermore, in the UK, the economy of the country showed an upward trend of 7.5 percent in 2021 after collapsing by 9.4 percent in the year 2020 ("United Kingdom GDP Growth Rate - 2021 Data - 2022 Forecast - 1955-2020 Historical", 2022). This advancement in the country’s economy will give a boost to the retail industry. Furthermore, by 2025, e-commerce grocery sales in the US are expected to grow rapidly at a CAGR of 21.5 percent. In the global context, the online grocery market is anticipated to grow at an impressive CAGR of 25.02 percent by 2024. The global online grocery market is expected to reach USD 663.33 billion by the end of 2024 (Markets, 2022). Moreover, in emerging markets such as India, the CAGR of online grocery shopping is projected at 28.99 percent (Yahoo is part of the Yahoo family of brands, 2022).

Social factors affecting Tesco

Citizens in countries like the UK, France, Canada, Australia, and the US are embracing modern lifestyles and have a preference for brands even in the retail industry. Even in the emerging economies of the world like India, Mexico, and Brazil people are now getting attracted to premium brands which is a great encouragement for the global retail industry. Also, grocery items and commodities are a part of the essential supply chain and consumers are buying products on a daily basis. Moreover, consumers are now attracted to the idea of convenience and comfort in terms of getting groceries delivered to their homes or buying from convenience stores.

Speaking of the level of consumerism, in the United Kingdom, private consumption in the United Kingdom is as high as 63 percent of the country’s nominal GDP("UK Private Consumption: % of GDP, 1955 – 2022 | CEIC Data", 2022). Besides, in the context of the United States, private consumption in the country accounts for 68.6 percent of the country’s nominal GDP ("US Private Consumption: % of GDP, 1947 – 2022 | CEIC Data", 2022). Higher levels of private consumption contribute to the positive factors for the industry.

However, the retail industry also needs to acknowledge the fact that customers' inclination towards sustainability is increasing and companies need to deliver on the same to acquire and retain customers as customers’ switching costs to sustainable businesses will be very low. To substantiate, if we talk about emerging economies, the consumer preference for sustainable brands is also increasing rapidly in these countries. In India, one of the most significant emerging markets, 48 percent of consumers want to buy from sustainable businesses showcasing environment-friendly behavior (Is 2022 the year when Indian brands will get more serious about sustainability? 2022)

Technological factors affecting Tesco

The global scenario at present is encouraging new technological innovations across all industries and ways of doing business. In this pursuit, the UK, the US, Japan, and China are leading the development of state-of-the-art technological innovations. These countries are investing significant parts of their GDP into research and development and these opportunities are increasing the scope of innovation for the grocery and retail industries.

The UK aims to become a global leader in technology by the end of 2025 and will be allocating larger funds to R&D. At present, the UK invests about 1.8 percent of its GDP in R&D. Besides, the US, China, and Japan are investing more than 3 percent of their GDP in R&D ("How much does your country invest in R&D?", 2022). With new technological innovations being developed, the retail industry can constantly optimize scalability, sustainability, and efficiency.

Even at present, a wide spectrum of new technologies is reshaping the operations in the grocery and retail industry. These technologies include IoT sensors in the supply chain, big data, automated inventory management, e-commerce channels, contactless deliveries, no checkout stores, direct-to-the-boot delivery, AI, delivery through drones, facial recognition, and voice commerce.

Legal factors affecting Tesco

In almost every leading economy of the world, the retail industry is regulated by strict anti-trust and anti-competitive laws that discourage the formation of cartels by some big retailers. Further, the anti-competitive laws protect suppliers from exploitation and aim to promote fair competition in the industry. In the United Kingdom, as per the mandate WEF from May 2021, retailers in the country irrespective of size must charge at least 10 pence for single-use carrier bags. Retailers may have to face fines if they are not charging the customers for carrier bags ("Carrier bag charges: retailers' responsibilities", 2022).

Besides, the UK Food Safety Act 1990 is widely applicable in the grocery and retail industry. Furthermore, labeling and packaging norms in the country require companies to provide information to customers about ingredients, allergens, conditions of storage, labeling of date, and details of nutrition. With greater transparency provided to customers, companies can acquire new customers more effectively.

Moreover, with respect to China, the largest consumer market, the industry has to comply with strict labor laws, an elaborative list of standards for consumer goods closely monitored data privacy laws, and norms related to advertising, labeling, and pricing. Besides, In India, retailers in the grocery and food segment have to procure licensing by the Food Safety and Standard Authority of India (FSSAI). Also, in India, the grocery retail and supermarket businesses have to comply with The Consumer Protection Bill 2019 which aims at promoting consumer rights in a more comprehensive way. Overall, the legal compliances for the industry are increasing with respect to consumer safety, food standards, misleading information through advertisements, and protection of consumer privacy and data.

Environmental factors affecting Tesco

The international community is now increasingly working together on sustainable initiatives and sustainable development goals. Most of the leading countries of the world including the UK, the US, China, India, and others have set future targets for zero emissions in the coming decades and these sustainability targets will drive major changes in the retail industry as well. Carbon footprint, waste generation, pollution, toxic chemical contaminants, and sustainability challenges in the supply chain are the major environmental issues in the retail industry. The UK government is mulling complete bans on single-use plastics in the near future to address the issue of plastic pollution. Further, The Waste Regulations 2011, The Environment Act 1990, The Hazardous Waste Regulations Act 2005 directly concern the retail industry in the United Kingdom.

Furthermore, in China, WEF September 2020, the sales and production of plastic bags that are not degradable and other disposable plastic items are prohibited. This prohibition came into effect after an amendment to the Law of the People’s Republic of China on the Prevention and Control of Environmental Pollution by Solid Wastes. Moreover, in the coming 5 years, China’s Ministry of Ecology and Environment will be bringing new regulations with respect to the production of harmful plastics. This will have a direct impact on the packaging, logistics, and other operations of the global grocery and supermarket retail industry. Similarly, India’s ban on single-use plastics will come into effect starting July 2022 which will have direct implications on the supermarket and grocery industry.

Overall, for the global grocery and supermarket retail industry, entering emerging markets like India and China is becoming increasingly challenging with respect to environmental norms. In the context of the larger picture, most nations of the world are now committed to cutting down on plastic pollution, promoting clean energy, and reducing greenhouse emissions to meet sustainable development goals and achieve their targets to be net-zero emission nations. The industry will have to innovate constantly in terms of sustainable practices to stay competitive in the longer run.

To encapsulate, positive factors for the industry include global free trade agreements, emerging economies' support to FDI in retail, increasing levels of consumerism, inclination towards e-commerce, and modern lifestyle of consumers pushing them to buy from supermarkets. However, increasing norms and global commitments with respect to sustainability, plastic packaging, transparency, and consumer rights pose challenges to the industry.

Recommended Readings

References

Tesco (TSCDF) - Market capitalization. (2022). Retrieved 12 February 2022, from https://companiesmarketcap.com/tesco/marketcap/

Atlantic Council. 2022. E-commerce is the latest target in India's push for an open digital economy. [online] Available at: https://www.atlanticcouncil.org/blogs/southasiasource/e-commerce-is-the-latest-target-in-indias-push-for-an-open-digital-economy/ [Accessed 16 February 2022]

Business Insider. 2022. Is 2022 the year when Indian brands will get more serious about sustainability?. [online] Available at: https://www.businessinsider.in/advertising/brands/article/is-2022-the-year-when-indian-brands-will-get-more-serious-about-sustainability/articleshow/88816095.cms [Accessed 16 February 2022]

How much does your country invest in R&D?. (2022). Retrieved 12 February 2022, from http://uis.unesco.org/apps/visualisations/research-and-development-spending/

UK Private Consumption: % of GDP, 1955 – 2022 | CEIC Data. (2022). Retrieved 12 February 2022, from https://www.ceicdata.com/en/indicator/united-kingdom/private-consumption--of-nominal-gdp#:~:text=United%20Kingdom%20Private%20Consumption%20accounted,an%20average%20share%20of%2063.7%20%25.

Markets, R., 2022. Global $663.33 Billion Online Grocery Market to 2024 with Potential Impact of COVID-19. [online] GlobeNewswire News Room. Available at: https://www.globenewswire.com/news-release/2020/11/23/2131523/28124/en/Global-663-33-Billion-Online-Grocery-Market-to-2024-with-Potential-Impact-of-COVID-19.html [Accessed 15 February 2022].

Finance.yahoo.com. 2022. Yahoo is part of the Yahoo family of brands. [online] Available at: https://finance.yahoo.com/news/india-online-grocery-market-report-122600520.html#:~:text=The%20online%20grocery%20market%20is,growth%20rate%20of%20about%2060%25. [Accessed 15 February 2022]

US Private Consumption: % of GDP, 1947 – 2022 | CEIC Data. (2022). Retrieved 12 February 2022, from https://www.ceicdata.com/en/indicator/united-states/private-consumption--of-nominal-gdp#:~:text=United%20States%20Private%20Consumption%20accounted,an%20average%20share%20of%2063.2%20%25

Carrier bag charges: retailers' responsibilities. (2022). Retrieved 12 February 2022, from https://www.gov.uk/guidance/carrier-bag-charges-retailers-responsibilities

United Kingdom GDP Growth Rate - 2021 Data - 2022 Forecast - 1955-2020 Historical. (2022). Retrieved 12 February 2022, from https://tradingeconomics.com/united-kingdom/gdp-growth

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register