Uber Overview

Uber is a US conglomerate that has various types of taxis including hatchbacks, sedans, and bikes in its network. The company is also engaged in a food delivery network by the name of UberEats. The company operates in more than 80 countries and serves more than 3.9 million customers globally (Saxena, 2022). The company has an enormous 12.75% market share in global taxi service. It has recently diversified its portfolio by venturing into the freight sector through the acquisition of Transplace. Uber employs about 26,900 personnel and it generated a revenue of $$17.45 billion in 2021, an increase of 57% over 2020 (Uber, 2021).

PESTLE analysis is an effective business tool used by businesses to get a clear comprehension of the macro environment and various factors that affect the industry in certain ways. PESTLE is an acronym for Political Economic. Social, Technological, Legal, and Environmental factors.

Hence, this article will highlight a thoroughly conducted PESTLE Analysis of Uber which presents various political, economic, social, technological, legal, and environmental factors that impact the ride-sharing industry in the market of US and UK. Furthermore, the article also covers the role of various emerging economies such as India and China affecting the industry in positive as well as negative ways.

Table of Contents

Exhaustive and precise PESTLE analysis of Uber

Political factors affecting Uber

The US is a lot more stable politically and this can be a positive sign for the companies as there would be certainty in the business environment. The state of Massachusetts in the US is planning to introduce a law wherein the ride-sharing companies would have to pay 10 cents fees per ride to the origin city (Sweeney Merrigan, 2022). This decision can have a financial impact on ride-sharing companies. The US has a tax treaty with 67 countries around the globe wherein the income earned by the companies in the sourced country is charged at a reduced rate and income from a few nations is fully exempted from tax. These agreements would ensure that companies do not have to pay tax on tax if they are operating internationally. The tax regime in the country is also favorable for the companies as the government has recently reduced the corporate tax rate from 35% to 21% (PwC, 2022).

The UK is another major market for the rise sharing companies and the tax regime in the UK is not favorable for the companies this is evident from the fact that the federal government is planning to hike the corporate tax rate from 19% currently to 23% from FY2023 for the companies who earn more than 50,000 pounds in profits (Pinsent Mansons, 2022). The Brexit has led to the unavailability of drivers in the UK as most of the labor was from the EU countries and the companies would have to downsize their operations for a short period because of this.

Besides, China has introduced a new policy for the ride-sharing platforms wherein the fees that the companies can charge the drivers have been capped and further it is mandatory for the companies to provide various facilities like insurance to the drivers and consider them at par with full-time employees. This can lead to an increase in the expenditure of the companies.

Economic factors affecting Uber

The US is witnessing consistent fluctuations in its growth. In 2021, the country grew by 5.7%. (Wiseman, 2022). Further, the growth is predicted to decline to 4% in 2022 and 2.6% in 2023 respectively (Shalal & Lawder, 2022). The economy is going through inflationary pressure at the current time and the inflation rate in 2021 was at a record high wherein it touched 7.5%.and the reason for high inflation is the decrease in the supply of commodities and the inability to cope with demand. The high inflation can lead to an increase in prices of fuel and cars which would force the customers to shift more to the rise sharing platforms in order to save their expenses.

Furthermore, the UK also witnessed a higher growth rate of 7.5% in 2021 (Smith, 2022). But, it is forecasted to lower significantly to 4.7% in 2022. The per capita income of the UK is expected to fall from $44,600 in 2021 to $42700 in 2023. The decline in per capita income would lower the ability of the people to purchase personal vehicles, therefore they would opt more for ride-sharing platforms, hence leading to an increase in the business for ride-sharing companies.

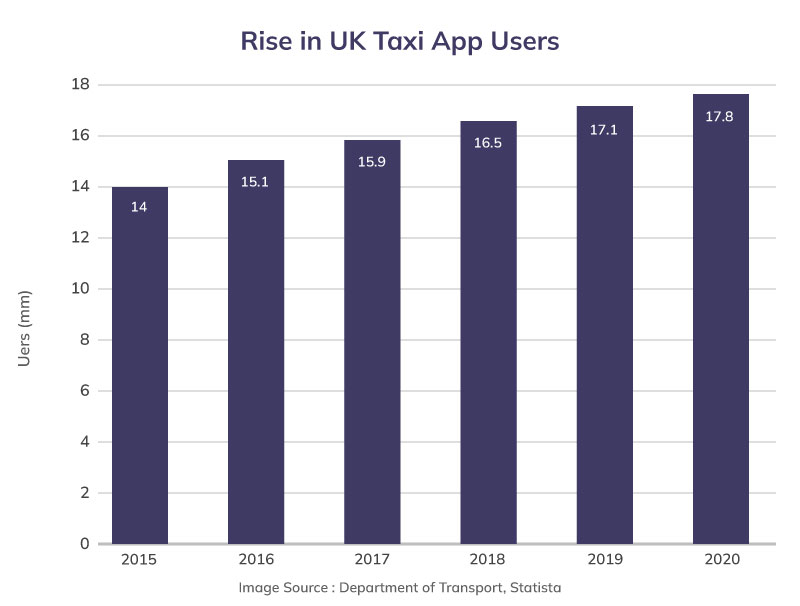

The increase in Taxi App Users in the UK over the last few years is illustrated in the below graphic.

Besides, the Chinese economy registered a huge growth of 8.1% in 2021 but it is expected to fall to 5.1% in 2022 and thereafter remain flat in 2023. The GDP per capita in China is expected to rise by a significant margin from $12,551 in 2021 to $25,307 in 2025. The huge rise in per capita income can increase the affordability of people purchasing personal cars. This can reduce the preference for ride-sharing.

The ride-sharing market in the US is valued at $73.5 billion and is expected to grow to $344.4 billion by 2030 at a CAGR of 16.7%, thus highlighting the huge potential for the companies (Globe News Wire, 2021). Further, Asia Pacific is considered to be the largest market for the ride-sharing industry accounting for 43% of the global market in FY 2020.

Social factors affecting Uber

The customer preference for ride-sharing taxis is increasing in the US over the years with over 58 million riders in 2018 that increased by a significant margin to 74.5 million in 2021 (Oberoi, 2021). The increase in ride-sharing preference is related to the increase in crude prices that have gone up to $130 in March 2022 from $47.62 in Jan 2021. The increase in crude prices has led to a surge in the prices of gasoline that has resulted in reduced the affordability of the customer's personal cars. Further, the high literacy rate of 79% has led to an increase in the adoption of various technologies among young people, therefore leading to an increase in the business of ride-sharing companies. But, the safety and privacy concerns among the citizens can act as a barrier for the ride-sharing companies (Dhar & Raina, 2021). Furthermore, the Chinese ride-sharing market is witnessing an upward trend as more and more people are discarding their personal vehicles because of environmental concerns.

Technological factors affecting Uber

The US government is promoting research and development on a huge scale wherein the government spent $157 billion on R&D in 2021, and the proposed investment for 2022 is pegged to be $171 billion (Connolly, 2021). Further, The UK government also spends heavily, it spent 38.5 billion pounds in 2020 and has set a budget to spend 39.8 billion a year in the next 4 years. Various technologies that have emerged in the ride-sharing business include the Internet of Things wherein they can access and track their drivers on a real-time basis. This can also help them analyze the probable violations such as driving more than specified hours or overspeeding (Rangaiah, 2020). Driverless taxis are another trend that is shaping the taxi industry (Naughton, 2022). Further, the use of artificial intelligence to forecast the demand on the routes ensures the availability of adequate cabs to ease the customer’s convenience and reduce their waiting time. The use of the Internet of Things enables the companies to centrally track all the drivers at one point in time, thus ensuring the safety of the passengers.

Legal factors affecting Uber

Antirust laws in the US prohibit companies from engaging in business deals to eliminate the competition and maintain a monopoly. The companies are not allowed to fix the price under The Sherman Act. This can impact the companies as they cannot set prices by collaborating with each other. Further, the PRO Act wherein the gig workers would be treated as permanent employees and the companies would have to provide them equal benefits like insurance, and paid leaves among others would increase the cost of operations for the ride-sharing companies (Nilsen, 2021).

Further, there are various laws that govern the ride-sharing taxis in the UK and these include employment law that defines the rights of the workers associated with the company and as the companies are involved in the collection of data as well, so they have to abide by the guidelines laid down in the Data Protection Act which states that the collected data is not sold to any other establishment for the commercial purposes. The data should not be kept for an indefinite period of time and should be destroyed when the purpose of collecting the data has been solved. The UK government has amended its employment law and reclassified the gig workers as full-time workers. This would increase the expenditure of the companies as they would have to provide more benefits like vacation pay, pensions, etc. to their drivers (Lomas, 2021). The intellectual property is fully safeguarded and the companies are granted patents for 20 years.

Besides, India is also one of the emerging markets for the rise of sharing companies and the government has introduced several initiatives to regulate the industry. These include limiting the workday for the driver to 12 hours and the companies cannot surge prices exponentially, they are only allowed to charge 1.5x the base price. The companies are also not allowed to charge more than 10% cancellation fees (Fortuna, 2020). These guidelines would limit the earning capacity of the ride-sharing companies to some extent.

Environmental factors affecting Uber

Ride-sharing taxis release about 50% more carbon emissions than privately-owned cars as they are involved in millions of trips on a daily basis (UCS, n.d.). The business of ride-sharing taxis running on fossil fuels can suffer setbacks because of pressure from various environmentalists groups, non-profit organizations, and EV100, which is a collation of 121 business entities to ban the gasoline vehicles by 2026. This can increase the operational cost of the companies as they would have to replace their fleet with environment-friendly options.

Further, the taxi industry contributes a lot to the carbon emissions in the UK as well, it produces about 3.5 million metric tons of emissions annually. The federal government of the UK has amended The Climate Change Act and it plans to reduce greenhouse gas emissions by 100% by 2050. This would result in more expenditure by the companies as they would have to replace their fleet with more sustainable vehicles which can prove to be costly.

To encapsulate, the ridesharing industry stands to benefit from the fact that there is a rise in environmental concerns among the people in China and hence more and more people are discarding their personal vehicles. Further, the high inflation in the US is also positive news for the companies as people would discard their personal vehicles and the companies can target them by offering rides at a low price. There can be a dent in the business of the companies as the GDP per capita in China is predicted to rise which can increase the demand and sales of the passenger vehicles. The ride-sharing companies pollute much more than personal vehicles and need to be cautious of the protests from various private organizations that are continuously demanding strict emission norms. This can be a setback for the ride-sharing industry as they would need to replace their vehicles that currently run on gasoline which can lead to an increase in their expenditure and can also temporary disruption the operations. Moreover, if you wish to analyze the internal capabilities of the company, you can delve into an astute SWOT analysis of uber conducted by us with extensive research.

Recommended Readings

References

Bursa, M. (2021). Shortage of drivers is causing a new crisis to thwart taxi trade’s post-Covid-19 revival. Retrieved 11 April 2022, from https://www.prodrivermags.com/news/shortage-of-drivers-is-causing-a-new-crisis-to-thwart-taxi-trades-post-covid-19-revival/

Climate Change COmmittee. A legal duty to act. Retrieved 11 April 2022, from https://www.theccc.org.uk/the-need-to-act/a-legal-duty-to-act/#:~:text=The%20Climate%20Change%20Act%20commits,20%25%20of%20the%20UK's%20emissions.

Global Times. (2022). China’s GDP per capita reaches $12,551 in 2021, overtaking global average GDP per capita: official. Retrieved 11 April 2022, from https://www.globaltimes.cn/page/202201/1246128.shtml

Lomas, N. (2021). Uber loses gig workers rights challenge in UK Supreme Court. Retrieved 11 April 2022, from https://techcrunch.com/2021/02/19/uber-loses-gig-workers-rights-challenge-in-uk-supreme-court/

PwC. (2022). Corporate - Taxes on corporate income. Retrieved 11 April 2022, from https://taxsummaries.pwc.com/united-states/corporate/taxes-on-corporate-income#:~:text=federal%20tax%20regime.-,P.L.%20115%2D97%20permanently%20reduced%20the%2035%25%20CIT%20rate%20on,a%20gross%20basis%20at%2030%25.

Shalal, A., & Lawder, D. (2022). IMF cuts growth forecasts for U.S., China and world as Omicron spreads. Retrieved 11 April 2022, from https://www.reuters.com/markets/us/imf-cuts-growth-forecasts-us-china-world-omicron-spreads-2022-01-25/.

Smith, E. (2022). UK economy grew 7.5% in 2021, mostly recovering from its pandemic plunge. Retrieved 11 April 2022, from https://www.cnbc.com/2022/02/11/uk-economy-grew-7point5percent-in-2021-mostly-recovering-from-its-pandemic-plunge.html

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register