Lyft Overview

Lyft is an on-demand ridesharing company based in California, US. Its business also includes rental vehicles and food delivery. The company was founded in 2012 and has operations in the US and Canada. It employs 22,434 personnel and earned a revenue of $3.2 billion, an increase of $800 million over 2020 (Lyft, 2021). The company has a network of more than 67k active riders and 12.5 million active riders (Lyft, 2021).

Such a large and well-established company often gets affected by the external and internal environment both positively and negatively. In such scenarios, there are multiple management tools that assist in identifying and studying the major drivers that affect a company’s performance. PESTLE is an acronym of Political, Economic, Social, Technological, Legal, and Environmental factors that describes the macro environment affecting the industry along with Lyft.

Hence in this blog, a detailed and well-elaborated PESTLE analysis is presented in reference to the ridesharing industry to meticulously understand the external environment that can affect one of the leading players of the industry, Lyft.

Table of Contents

Elaborative PESTLE analysis of Lyft

Political factors affecting Lyft

The state of Massachusetts in the US is planning to introduce a law wherein the ride-sharing companies would have to pay 10 cents fees per ride to the origin city (Sweeney Merrigan, 2022). Further, many states have increased the tax on ride-sharing companies recently, for example, Washington increased the sales tax from 1% to 4.5% quite recently. These decisions can result in financial burdens and reduced earnings for the companies resulting in the need for effective change management.

Economic factors affecting Lyft

The growth rate of the US for the year ending 2021 was 5.7%. . But it is predicted to decline to 4% in 2022 and 2.6% in 2023 respectively (Shalal & Lawder, 2022). Further, the per capita income in 2021 was $63, 416 while it is expected to lower to $55000 in 2022 and $57000 in 2023. The decline in growth rate and per capita income would lower the real income of the people, therefore they would opt more for ride-sharing platforms to cut their expenses, hence leading to an increase in the business for ride-sharing companies. But, the rise in inflation by 7.5% over the last 1 year and 0.6% in the last month can result in a higher fare structure, thus negatively impacting the business (Bartash, 2022). Further, it is also being anticipated by experts that the soaring fuel prices in the wake of the Russia-Ukraine conflict can have negative economic repercussions for the entire world.

Speaking of the growth rate in the industry, the ride-sharing market in the US is valued at $73.5 billion and is expected to grow to $344.4 billion by 2030 at a CAGR of 16.7%, thus highlighting the huge potential for the companies (Globe News Wire, 2021).

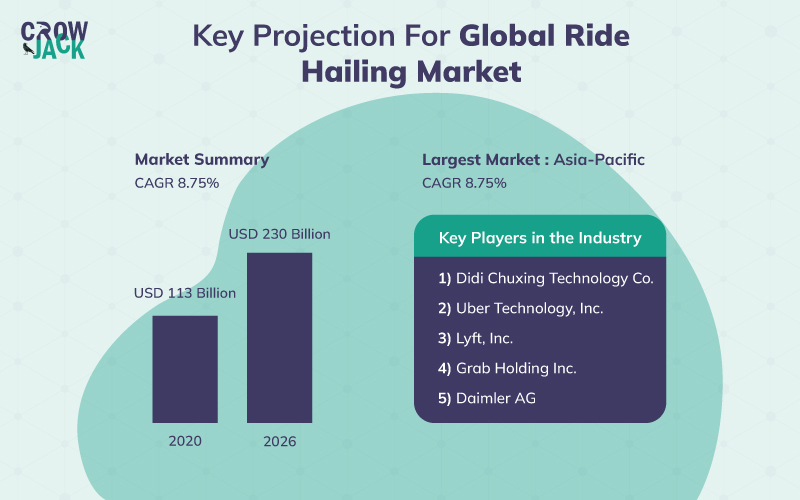

To add, in the global perspective, as per Mordor Intelligence, the ride-hailing market is anticipated to reach 230 billion by 2026 growing at a CAGR of 8.75 percent worldwide.

Social factors affecting Lyft

The customer preference towards ride-sharing taxis is increasing in the US over the years with over 58 million riders in 2018 that increased by a significant margin to 74.5 million in 2021 (Oberoi, 2021). Further, the high literacy rate of 79% has led to an increase in the adoption of various technologies among young people, therefore, increasing the business of ride-sharing companies. But, the safety and privacy concerns among the citizens can act as a barrier for ride-sharing companies. Also, because of the rising fuel prices due to the Russia-Ukraine crisis, more people will move towards cab sharing and ride-hailing services rather than using their private vehicles in a frequent manner. This can be seen as a positive development for the industry.

Technological factors affecting Lyft

The US government is promoting research and development on a huge scale wherein the government spent $157 billion on R&D in 2021 and the proposed investment for 2022 is pegged at $171 billion. Various technologies that have emerged in the ride-sharing business include the Internet of Things wherein they can access and track their drivers on a real-time basis. This can also help them analyze the probable violations such as driving more than specified hours or overspeeding (Rangaiah, 2020). Driverless taxis are another trend that is shaping the taxi industry (Naughton, 2022).

Legal Factors affecting Lyft

The antitrust laws in the US prohibit companies from engaging in business deals to eliminate the competition and maintain a monopoly. The companies are not allowed to fix the price under The Sherman Act. This can impact the companies as they cannot set prices by collaborating with each other. Further, the PRO Act wherein the gig workers would be treated as permanent employees and the companies would have to provide them equal benefits like insurance, paid leaves among others would increase the cost of operations for the ride-sharing companies (Nilsen, 2021).

Environmental factors affecting Lyft

The ride-sharing taxis release about 50% more carbon emissions than the privately-owned car as they are involved in millions of trips on a daily basis (UCS, n.d.). The business of ride-sharing taxis running on fossil fuels can suffer setbacks because of pressure from various environmentalist groups, non-profit organizations, and EV100, which is a coalition of 121 business entities to ban gasoline vehicles by 2026. This can increase the operational cost of the companies as they would have to replace their fleet with environment-friendly options. Also, the global commitments to the United Nations Sustainable Development Goals will have an impact on the industry that needs to be accounted for. Also, to learn about the internal strengths and weaknesses of the company, you can go through our diligent SWOT Analysis of Lyft.

Recommended Readings

References

Sweeney Merrigan. (2022). Overview of New Rideshare Legislation in Massachusetts. /www.sweeneymerrigan.com. Retrieved 14 March 2022, from https://www.sweeneymerrigan.com/blog/new-ridesharing-legislation-massachusetts/

Shalal, A., & Lawder, D. (2022). IMF cuts growth forecasts for U.S., China and world as Omicron spreads. www.reuters.com/. Retrieved 14 March 2022, from https://www.reuters.com/markets/us/imf-cuts-growth-forecasts-us-china-world-omicron-spreads-2022-01-25/

Bartash. (2022). U.S, inflation rate climbs to 7.5% after another sharp increase in consumer prices. www.marketwatch.com. Retrieved 14 March 2022, from https://www.marketwatch.com/story/coming-up-consumer-price-index-11644498273.

Globe News Wire. (2021). Ride Sharing Market Size to Worth Around US$ 344.4 Bn by 2030. /www.globenewswire.com. Retrieved 14 March 2022, from https://www.globenewswire.com/news-release/2021/09/28/2304958/0/en/Ride-Sharing-Market-Size-to-Worth-Around-US-344-4-Bn-by-2030.html

Rangaiah, M. (2020). How is IoT being used by the ridesharing industry?. www.analyticssteps.com. Retrieved 14 March 2022, from https://www.analyticssteps.com/blogs/how-iot-being-used-ridesharing-industry.

Naughton, K. (2021). Ford, Lyft and Argo Team Up to Deploy Robo-Taxis. www.bloomberg.com. Retrieved 14 March 2022, from https://www.bloomberg.com/news/articles/2021-07-21/ford-lyft-and-argo-team-up-to-deploy-robo-taxis-this-year

Nilsen, E. (2021). The House just passed a sweeping and bipartisan bill to boost unions. www.vox.com. Retrieved 14 March 2022, from https://www.vox.com/platform/amp/22319838/house-passes-pro-act-unions

UCS. Ride-Hailing is a Problem for the Climate. Here's Why.. www.ucsusa.org. Retrieved 14 March 2022, from https://www.ucsusa.org/resources/ride-hailing-problem-climate

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register