Ford Overview

Ford is a highly popular automotive brand with a market capitalization of USD 64.5 billion as per Yahoo Finance. Besides, Ford is headquartered in Michigan, United States and has earned an impressive global presence since its incorporation in June 1903. To elucidate, Ford has its operations spread across more than 125 countries. In 2021, The company earned a revenue of $17.9 billion. Moreover, the company has a strong employee base of around 182,000 workers in different segments.

Ford’s vision is to help build a better world, where every person is free to move and pursue their dreams. To achieve its vision, the company has a portfolio of many vehicles that customers can choose based on their preferences.

However, for sustaining its advantage and realizing the opportunities in the external business environment, Ford needs to conduct a strategic analysis using the PESTLE Model at regular intervals. Having said that, this insightful article offers a comprehensive and astute PESTLE Analysis of Ford with respect to the automotive industry in the US as well as the emerging markets of the world.

Table of Contents

A critically examined PESTLE Analysis of Ford

Political factors affecting Ford

The US has a stable government and a stabilized political environment that favors a progressive commercial environment in the country. The federal government of the US has announced that all the vehicles sold by 2030 will be electric (Wayland, 2021). This will have huge implications for the automotive companies manufacturing gasoline vehicles traditionally as it will require the companies to completely shift their manufacturing to EVs. Moreover, the federal government of the US has recently announced a reduction in corporate tax from 35% to 21% to boost investments. This will have positive repercussions on the automotive industry in the country.

Further, the companies operating internationally can benefit from the tax treaty that the US has with 85 countries under which the income earned in a few nations by the US companies is taxed at a lower rate while earnings from many countries are tax-free (IRS, 2022). However, the auto industry is having production issues due to the global chip shortage as a result of COVID and the production could further get impacted because of the ongoing war between Russia-Ukraine as Ukraine is the major supplier of the neon supplies used to manufacture the semiconductor chips.

Furthermore, China is also one of the major markets for the automobile industry and the government of China has announced that it would eliminate the subsidies for electric vehicles by the end of 2022. This would lead to an increase in the manufacturing cost for the companies. Further, the government of China has withdrawn the policy wherein the ownership of foreign companies in car manufacturing was limited to 50% and now the companies can operate full-fledged on their own. This would provide the companies with more control over their operations.

To add, the government of China is planning to implement a law wherein the vehicles would be required to clear the in-car air quality tests, hence the companies would have to modify the internal parts.

Economic factors affecting Ford

The growth rate of the US for the year ending 2021 was 5.7%, the highest since 1984 (Wiseman, 2022). However, it is further predicted to decline to 4% in 2022 and 2.6% in 2023 respectively (Shalal and Lawder, 2022). Economic destabilization in the country could have negative repercussions on the automotive industry. Further, the unemployment rate is decreasing continuously. It was 3.9% by the end of 2021 and is expected to fall in 2022 to 3.8% and 3.5% in 2023 (Knoema, 2021). The lowering of the unemployment rate would lead to an increase in sales as more people would have fixed sources of income.

Further, the inflation in the US is at a 40-year high of 7.5%. The reason for higher inflation is the reduction in the supply of goods and services due to COVID and the current level of supply is not able to match the demand in the market. The higher inflation rate would lead to an increase in the prices of cars, hence reducing the affordability for many customers.

Going further, speaking of China's economic indicators, the growth rate at the end of 2021 was 8.1% (Patranobis, 2022). The economy is expected to slow to 5.1% in 2022 and 2023. The per capita income in China was $12,551 at the end of 2021 (Global Times, 2022). It is expected to more than double to $25,307 by 2025.

The high increase in income would lead to an increase in the sales of the automobile companies by manifolds. Further, The central bank of China has decreased the interest rates to 3.7% which can be good news for the auto companies as customers would get the credit at a lesser rate, hence leading to an increase in their purchasing power (Choudhary, 2022).

Talking about South Africa, another important emerging market, the growth rate in 2021 was 4.9% and it is predicted to drop by more than half to 2.1% in 2022 (Rolland, Marais & Spangenberg, 2022). Moreover, the annual inflation rate for 2021 was 5% and it would rise slightly to 5.3% in 2022. The moderate inflation rate means there won’t be a significant impact on the prices, hence there would not be a major reduction in the purchasing behavior of the customers.

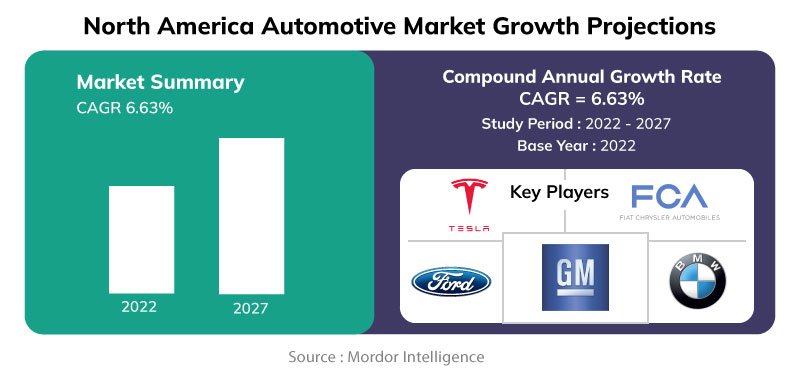

The automobile industry in the US is worth $82.6 billion and the most sales were in the light vehicle segment amounting to 14,471,800 vehicles. The automotive industry is regarded as the backbone of the US economy as it accounts for 3% of the country’s GDP (Ariella, 2021). Further, the automotive market in North America is expected to grow at a CAGR of 6.63 percent between 2022 and 2027 reaching a value of USD 970.23 billion in the course of the forecast period.

Furthermore, as per Business Wire, the automotive industry in China is anticipated to grow at an impressive CAGR of 7.5 percent till 2025. Furthermore, the market size is expected to reach USD 8.5 billion by the end of 2025.

Social factors affecting Ford

The trend of electronic vehicles is on the rise in the US with 39% of customers preferring to buy an electric car as their next purchase. Further, 57% of millennials prefer phasing out gasoline vehicles (Spencer& Funk, 2021). Further, China, another major market for the automobile industry is witnessing a tremendous shift in the purchasing behavior of the customers wherein more than 85% of people are preferring to purchase vehicles online, hence signifying the need for the companies to market their products online and have a strong digital infrastructure.

Alongside China, 70% of customers in another emerging market South Africa prefer safety features when buying a car, hence signifying the need for the auto companies to manufacture more efficient vehicles.

Overall, the customer sentiment in the automotive industry is now inclining towards enhanced safety features and sustainability. Consumers expect car brands to offer improved safety features and more appealing styles. Especially, among the younger generations, car brands offering appealing features and specifications are highly popular.

Technological factors affecting Ford

The US government spends the highest on Research and Development in the world. It spent $157 billion in 2021 and the expenditure for 2022 is estimated to be $171 billion while the government of China spent 2 trillion yuan in 2021 (National Bureau of Statistics, 2022).

Various technologies have emerged in the automobile industry that including autonomous vehicles wherein the vehicles have the ability to steer themselves by detecting their surroundings based on the sensors and the vehicles can automatically maintain a safe distance from the traffic ahead.

Furthermore, 3D printing for manufacturing various automobile parts is gaining importance and big data analytics for gathering various forms of data can prove to be beneficial for predictive maintenance, managing the fleet can also help minimize the impact of accidents by alerting the authorities (Brown, 2021).

In addition, the wireless charging concept in electric vehicles wherein no physical charger is required provides more convenience to the customers when charging the electric vehicles in public areas. The companies are also experimenting with advanced batteries that run on graphene-based technology and can get fully charged in just 15 seconds (Driivz, 2020).

Moreover, there are various emerging battery technologies in the EV segment that will disrupt the future of the automotive industry. The sooner the companies look to exploit these technologies the greater will be their competitive advantage.

Legal factors affecting Ford

The regulations that govern the automobile industry in the US include the newly passed Infrastructure Act and National Traffic and Motor Vehicle Safety Act along with the Antitrust Laws. Under the Infrastructure Act, it would be mandatory for auto companies to install alcohol monitoring systems in cars to prevent accidents (Goodkind, 2021).

Further, it is mandatory for the companies to install keyless ignition devices and an internal combustion engine device or system from 2024 to automatically shut off the vehicle in order to reduce carbon monoxide.

These requirements would increase the prices of cars. The National Traffic and Motor Vehicle Safety Act deals with the safety standards related to designing, manufacturing, and operations of vehicles. The National Highway Traffic Safety Administration is responsible for enforcing the vehicle performance standards and it is empowered with the right to conduct inspections at the manufacturing plants and provides safety ratings to the vehicles along with possessing the authority to recall the unsafe vehicles.

Under the antitrust law, the companies are prohibited from engaging in mergers with an intention to reduce competition in the market, and the company found violating the laws can face up to $100 million in fines, and executives can be imprisoned for a period of 10 years. Further, it is illegal under The Sherman Act to fix prices, divide markets, or rig bids (Federal Trade Commission, 2022).

Alongside the US, the auto industry has to abide by certain regulations in China as well. These include the Labour Law, Data Regulation Act, etc. The government of China has amended the Data Regulation Act wherein the data collected by the companies should be stored within the territory of China and could not be transferred overseas without prior permission from the regulator. This would impact the companies dealing with autonomous vehicles (Chen, 2021).

Further, under the labor law it is mandatory for the companies to enter into an employment contract at least by the end of the first month of hiring the employee and if the organization fails to formulate a contract then it would be liable to pay double the agreed salary and the companies cannot indulge in mass layoffs. If the company has to lay off more than 10% of its workforce, then it needs to gain approval from the labor bureau (Acclime, n.d.). The Chinese government promotes innovation on a large scale wherein it grants the patents for a period of 20 years and further the patents can be extended for a period of 5 years on special provisions.

India is also one of the emerging markets for the automobile industry and the major law that governs the industry include The Motor Vehicle Act wherein the government has recently made amendments and it is mandatory for the companies to deploy 6 airbags in the vehicles from 2023. This would lead to an increase in the prices of the vehicles.

All in all, laws governing the automotive industry are changing swiftly and becoming stricter. Companies will need to rely on effective change management to adjust to these challenges posed by the changing legal environment.

Environmental factors affecting Ford

The automobile sector contributes highly to the US greenhouse gas emissions. The emissions resulting from each car amount to 4.6 tons per year. The agencies responsible for framing the laws regarding the emissions include the Environmental Protection Agency (EPA), the National Highway Traffic Safety Administration (NHTSA), and the California Air Resources Board (CARB).

The federal government has launched a Zero-Emission Vehicle program wherein 50% of passenger cars and light-duty trucks would be manufactured by adhering to zero-emission standards. This would lead to an increase in cost for the companies as they would have to research new technologies to manufacture the vehicles.

Moreover, the government of China has introduced new norms under which the companies would have to upgrade their engines to national 6. This is being done to reduce the emission of nitrogen oxides by 40% to 50% by 2023. In addition, the auto industry would have to shift to green operations as the government of South Africa has announced its target to reduce carbon emissions by almost a third (Farand, 2021).

To encapsulate, the auto companies can indulge in the production of EVs to a great extent as the governments like US and India are promoting its production by offering incentives. Further, the changing trend among the people in the form of more awareness about environmental pollution is leading to people shifting away from gasoline vehicles and preferring more EVs.

The companies can highly benefit if the technology that enables the battery to charge in a few seconds gets successful. The companies need to be aware of the changing environmental policies wherein the US government has set a target of producing half of the vehicles to be manufactured from 2030 would be emission-free and the Chinese government has also toughened its emission norms. The companies would have to research new technologies to adapt to the government’s conditions.

Moreover, if you wish to evaluate the internal strengths and weaknesses of Ford to understand how effectively it can deal with the changing external environment, you should read our ingenious SWOT Analysis of Ford.

Recommended Readings

References

Centre for Climate and Energy Solutions. (2022). Federal Vehicle Standards. www.c2es.org. Retrieved 4 April 2022, from https://www.c2es.org/content/regulating-transportation-sector-carbon-emissions/.

Chen, H. (2021). China issued the auto data regulation impacting auto industry greatly. www.jdsupra.com. Retrieved 4 April 2022, from https://www.jdsupra.com/legalnews/china-issued-the-auto-data-regulation-4766436/#:~:text=China%20issued%20the%20Regulation%20on,the%20processing%20of%20automobile%20data

GOODKIND, N. (2021). Infrastructure bill says anti–drunk driving technology must be built into new cars. But what that actually means is unclear. fortune.com. Retrieved 4 April 2022, from https://fortune.com/2021/11/15/infrastructure-bill-mandates-new-cars-include-anti-drunk-driving-technology-as-automakers-worry-about-impact-on-liability/.

MCCANDLESS, J. (2021). 20 Ways the Biden Infrastructure Bill Affects the Auto Industry. www.newsweek.com. Retrieved 4 April 2022, from https://www.newsweek.com/20-ways-biden-infrastructure-bill-affects-auto-industry-1622980.

SPENCER, A., & FUNK, C. (2021). Electric vehicles get mixed reception from American consumers. /www.pewresearch.org. Retrieved 4 April 2022, from https://www.pewresearch.org/fact-tank/2021/06/03/electric-vehicles-get-mixed-reception-from-american-consumers/

Sun, Y., & Goh, B. (2020). China considers in-car air quality regulations - sources. www.reuters.com. Retrieved 4 April 2022, from https://www.reuters.com/article/us-china-autos-policy-idUSKBN24A0MS

TABETA, S. (2019). China's new emissions rules take scalpel to bloated auto industry. /asia.nikkei.com/. Retrieved 4 April 2022, from https://asia.nikkei.com/Business/Business-trends/China-s-new-emissions-rules-take-scalpel-to-bloated-auto-industry

The National Law Review. (2021). Amendment to China Patent Law Offer PTA, PTE and Patent Linkage. www.natlawreview.com/. Retrieved 4 April 2022, from https://www.natlawreview.com/article/amendment-to-china-patent-law-offer-pta-pte-and-patent-linkage

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register