Dunkin Donuts Overview

Dunkin Donuts is a US-based Quick Service Restaurant chain that sells different varieties of coffee, donuts, bagels, croissants, muffins, sandwiches, and many other dishes. The company was founded in 1950 and has a network of more than 11300 restaurants spread across 36 countries including the US, Canada, India, Japan, the UK, Russia, New Zealand, etc. (Dunkin Donuts, 2021). Dunkin Donuts is owned by Inspire, a company that also owns other popular food brands such as Arby’s, Baskin Robbins, Buffalo Wild Wings, Rusty Taco, and SONIC among others. Dunkin Donuts earned a revenue of $972.1 million in 2020.

The PESTLE analysis of Dunkin Donuts presented in this article will delve deep into understanding the impact of external business factors on the operations and strategies of the company. If you wish to know in detail how an effective PESTLE analysis can be conducted, you can check out our holistic guide on PESTLE Analysis for in-depth understanding. To proceed, let us get the Dunkin Donuts’ PESTLE Analysis underway.

Table of Contents

Exhaustive and rational PESTLE analysis of Dunkin Donuts

Political factors affecting Dunkin Donuts

The US has a stabilized political environment that favors a progressive commercial environment in the country. The US has a friendly tax regime wherein the government recently reduced the corporate tax rates from 35% to 21% to boost the investments. Further, QSR companies import a large number of coffee beans from Brazil and both the governments have signed an agreement called Trade and Economic Cooperation under which many items including the green coffee beans imports from Brazil are duty-free, thereby leading to a reduction in cost for the companies (USTR, 2022).

Further, Canada is another key market for QSR companies and it is ranked higher in terms of political stability, thereby ensuring a positive environment for the business. The provincial government of Quebec has banned the opening up of fast-food restaurants near schools. This can impact the sales of the QSR companies (Goldberg, 2019).

Economic factors affecting Dunkin Donuts

The growth rate of the US for the year ending 2021 was 5.7%, (Wiseman, 2022). It is further predicted to decline to 4% in 2022 and 2.6% in 2023 (Shalal and Lawder, 2022). Further, the unemployment rate was 3.9% at the end of 2021 (Pickert, 2022). It is expected to fall further in 2022 to 3.8% and 3.5% in 2023 (Knoema, 2021). No positive change in the unemployment rate would lead to an increase in demand for affordable food products.

Furthermore, inflation in the US is at a 40-year high of 7.5%. The reason for higher inflation is the reduction in the supply of goods and services due to COVID and the current level of supply is not able to match the demand in the market. The higher inflation rate would lead to an increase in the prices of products, hence reducing the affordability for many customers.

Besides, Canada's growth rate at the end of 2021 was 6.7% (CBC, 2022). The economy is expected to slow down to 4.1% in 2022 (TD Bank, 2022). Inflation in Canada is at a record high of 5.1% (Statistics Canada, 2022). The inflation is expected to decrease to 3.3% in 2022 and further fall to 3.1% in 2023. The reduction in inflation means the QSR companies would be able to procure raw materials at a lesser rate, thereby leading to a reduction in prices which would ultimately lead to an increase in the sales of the QSR companies.

Furthermore, QSR companies import coffee beans and other bakery stuff from other countries and the fluctuation in exchange rates can impact the cost of the products, ultimately having an effect on the financials of the companies.

Most of the outlets are leased and rented by the QSR companies and the commercial rental rates in the US have increased by 1.2% (Lupa, 2021). But, the rates have continuously declined in the Canadian market by 0.5% and 0.6% in the last two quarters.

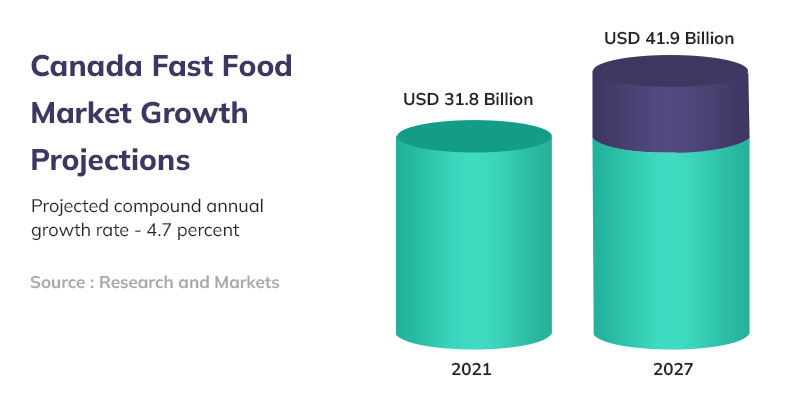

The Quick Service Restaurant in the US is valued at $260 billion and is predicted to grow by 7.1% and reach $295 billion by 2022. Further, the QSR industry in the US is forecasted to grow at a CAGR of 4.10% to $660 billion from 2022-to 2026. Besides, the growth projections with respect to the fast-food industry in Canada are represented by the subsequent graph.

Social factors affecting Dunkin Donuts

The consumption of fast food is increasing in the US market. More than 35% of people consume fast food on a daily basis. Further, the customers are preferring to eat at home to prevent themselves from the transmission of viruses which has led to an increase in demand for online food delivery by 8%, thereby signifying the importance of e-commerce for the companies in the QSR segment (Ahuja, 2021).

Furthermore, Canadians are changing their eating habits on a large scale and almost 50% of the population is shifting to healthy food items (Powell, 2017). The sales of healthy foods have risen by 57% in Canada in the last 5 years. This can provide QSR companies the opportunity to explore new markets.

Technological factors affecting Dunkin Donuts

The US government spent $157 billion on R&D in 2021 and the proposed investment for 2022 is pegged to be $171 billion (Connolly, 2021). The Canadian Government spent $40.1 billion in 2021 (Statistics Canada, 2021).

Various technologies are revolutionizing the way the QSR industry operates. For example, robots for taking orders and preparing food. Further, drones are being used for the delivery of parcels. In addition, self-service kiosks wherein the customers can order and pay through screens enhances the customer experience. Big data analytics, smart inventory management, automated solutions, and cloud kitchens are also transforming the industry at a fast pace.

The use of artificial intelligence to predict the demand for a specific product or the time when the demand is at its peak is gaining trend. This ensures optimized inventory levels, thus leading to enhanced customer satisfaction. However, to integrate these changes successfully such that they can optimize efficiency, companies will need to deploy the relevant change management models.

Legal factors affecting Dunkin Donuts

In the US, it is mandatory for restaurants to publish the calorie and nutritional information for all the items on the menu (FDA, 2018). The US government encourages innovation in various fields by granting an exclusive right to the technology through patents for the period of 20 years from the date of filing. The other legal factor that can impact the QSR industry is the increase in minimum wages across 21 states (Squires, 2022). This decision by the government can lead to an increase in expenditure for the companies.

In addition, various regulations that govern the QSR industry in Canada include the Food Retail and Food Services Code, and Anti-Spam Legislation among others. The Food Retail and Food Services Code contains guidelines for ensuring the safety of food and safeguarding public health. Under this, the Canadian Food Service Inspection Agency is empowered to conduct the health inspections of the restaurants and provide the restaurants with a health grade which is to be displayed at the front of the facility (Freeborn, 2017).

The Anti-spam legislation is concerned with the ethical marketing of the products and in this, it is mandatory for the companies to acquire the consent of the individuals before sending them the promotional messages electronically.

Environment factors affecting Dunkin Donuts

The US has re-joined the Paris Agreement and the federal government has announced to cut the emissions by half by 2030 to abide by the agreement. This can lead to the formulation of stricter policies which can impact the QSR industry as it contributes around 15% to the greenhouse gas emissions. Further, various environment-related policies such as banning single-use plastic by the federal government of the US can lead to an increase in the cost of operations for the QSR industry as they would have to opt for expensive options for packaging the food and providing cutlery.

Furthermore, Canada has recently introduced The Canadian Net Zero Emissions Accountability Act wherein the government has proposed to achieve net-zero emissions by 2050 (Government of Canada, 2022). Hence, the companies would have to invest in the R & D of innovative techniques to conduct business in an environment-friendly manner.

To encapsulate, Brazil is the largest coffee exporter in the world and the QSR companies can save their expenses as the US has an agreement with Brazil wherein the import of coffee from Brazil in the US is tax-free. Further, the QSR companies in both US and Canada have the advantage of selling affordable products, and the negative shift in economic parameters like growth rate, inflation rate, and other parameters wouldn’t have much impact on their sales.

Furthermore, the companies can benefit from the trend related to the high consumption of fast food in the US. The companies need to be cautious while entering the market as it is mandatory for them to publish the nutritional value of the products and in Canada, the companies need to attain the consent of the customers before sending them the messages related to the marketing.

Both the governments of the US and Canada are focusing on environmental sustainability and have introduced various norms like banning single-use plastic. This can be a challenge for the QSR companies as they have to opt for alternate and more expensive options for packaging the products and providing cutlery.

Also, you can read our well-researched and pragmatic SWOT Analysis of Dunkin Donuts to evaluate the strengths and weaknesses of the company. These strengths and weaknesses play a crucial role in terms of exploiting opportunities or mitigating threats identified using this PESTLE analysis.

Recommended Readings

Chipotle Mexican Grill PESTLE Analysis

References

CNBC. (2021). Fast-food chains close some indoor seating as U.S. cities mandate vaccine checks. Retrieved 11 April 2022, from https://www.cnbc.com/amp/2021/10/01/fast-food-chains-close-some-indoor-seating-as-us-cities-mandate-vaccine-checks.html

FDA. (2022). Menu Labeling Requirements. Retrieved 11 April 2022, from https://www.fda.gov/food/food-labeling-nutrition/menu-labeling-requirements#:~:text=The%20menu%20labeling%20requirements%20apply,substantially%20the%20same%20menu%20items.

Federal Trade Commission. (2022). The Antitrust Laws. Retrieved 11 April 2022, from https://www.ftc.gov/tips-advice/competition-guidance/guide-antitrust-laws/antitrust-laws

Goldberg, P. (2019). Superior Court upholds Montreal By-Law Restricting Fast Food Restaurants Near Schools. Retrieved 11 April 2022, from https://www.spiegelsohmer.com/en/2019/11/12/superior-court-upholds-montreal-by-law-restricting-fast-food-restaurants-near-schools/?utm_source=Mondaq&utm_medium=syndication&utm_campaign=LinkedIn-integration

Pickert, R. (2022). U.S. Jobless Rate Falls as Wages Jump, Adding Pressure on Fed. Retrieved 11 April 2022, from https://www.bloomberg.com/news/articles/2022-01-07/u-s-adds-fewer-jobs-than-forecast-unemployment-rate-falls

Shalal, A., & Lawder, D. (2022). IMF cuts growth forecasts for U.S., China and world as Omicron spreads. Retrieved 11 April 2022, from https://www.reuters.com/markets/us/imf-cuts-growth-forecasts-us-china-world-omicron-spreads-2022-01-25/

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register