Netflix Overview

In the contemporary world, OTT platforms have emerged as the primary source of entertainment for all generations. In fact, these platforms were the only source of entertainment when people remained in lockdown in their houses for months in the grip of the COVID-19 pandemic. Speaking of OTT platforms, Netflix has a leading position with a 25 percent market share in the US as per reports.

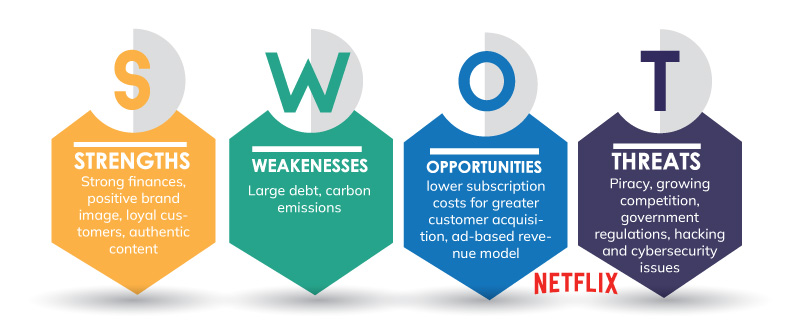

This article presents a compelling SWOT analysis of Netflix that intelligibly evaluates the strengths and weaknesses of the leading OTT platform along with opportunities and threats. In case you wish to learn about conducting a SWOT analysis in detail, you should definitely go through our meticulous Swot Analysis guide. So, let’s get started!

Table of Contents

An insightful SWOT analysis of Netflix

Netflix Strengths

Exponential growth- Netflix’s annual report reveals that the revenue is growing quarter by quarter, in Q42020 the revenue was $6644 million which increased to $7342 million in Q22020 and ultimately finished at $7709 million in Q42021. The operating margin has grown by five times from 4.3% in 2016 to 20.9% in 2021. In addition, the cumulative growth return has witnessed exponential growth. In the last 1 year, the stock has generated a return of 11% while the return amounts to 5985% in the last 10 years. The shows that have contributed to the growth include The Witcher, You, Emily in Paris, Squid Games, etc.

Brand image- Netflix has a strong brand image and in 2019, the company was ranked at the top in the reputation institute because of its efforts to widen its reach in the market and create innovative content (NASDAQ, 2019).

Global customer base- Netflix is liked worldwide and the company has been able to garner 222 million subscribers (SIlberling, 2022). Its content is viewed throughout the globe in more than 190 countries.

Original content- Netflix has its own production house and the company attains copyrights for all the content on the platform. This provides the company with an advantage as no other company is able to legally copy the content and showcase it on its own platform and this way Netflix is able to increase its viewership.

Netflix Weaknesses

High debt- Netflix has an enormous amount of debt ranging to more than $15 billion. The high debt signifies the rising liability of the company which the company needs to repay. Moreover, a significant increase in liabilities can result in a lowering of investor’s confidence.

More carbon emissions from operations- The company produces high carbon emissions and it is said that half an hour of streaming of Netflix equals emissions released by driving six miles by car. The company needs to be environmentally sustainable to be able to sustain the changing environment.

Opportunities for Netflix

Lower price plan- In the US and many other international markets, the company’s premium plan costs close to $20 per month which many people cannot afford. The company can reduce the prices and launch other flexible plans to increase its customer base and capture more markets.

Modification in business model- The content that is featured on the platform does not create an ad. The company can exploit the opportunity and use its popularity to generate more revenues by switching to an ad-based business model.

Threats for Netflix

- Piracy- Netflix is incurring huge losses because of the piracy of its content. According to an estimate, the company loses around $192 million due to piracy (Perez, 2019). Various apps like TeaTV and Popcorn Time copy the content from Netflix and stream it on their platform for free.

- Competition- Netflix is in a tough fight with many other OTT players like Amazon Prime, Disney+, Hulu, and others. Netflix is dominant in the US market and had control over 25% of the OTT market in Q4 2021. Amazon Prime trails Netflix by a slight margin of 6% and had a 19% market share in the last quarter of 2021 in the US but has the competitive advantage of lower and customized priced plans, the prices start at $7.49 per month for students whereas regular price is flat at $14.99 per month. Disney+ was in the third position with a 13% market share. Apple+ has very less market share but it can prove to be a great threat if it starts producing its own quality content (Esposito, 2022).

- Government regulations- The changing government regulations can cause interruptions in the smooth operations of the company. For example, in India, the government just framed new laws for the OTT platforms that require the companies to provide a parental lock for the mature content and set up an age verification mechanism. Likewise, many other countries like Malaysia, the Philippines are forming new laws.

- Loss due to account hacking- Many customers have reported of their accounts getting hacked and because of that, the company loses out on lots of revenue as people do not subscribe to their service and rather use hacked accounts to view the content.

Most of the content shown on Netflix's platform is produced by the company itself and it has produced some worldwide renowned programs like Squid Games, Narcos, etc. Further, the customer base that the company has all over the world can act to its advantage in terms of sustaining in the market for a longer time. The operations involve the release of high carbon emissions and the company does not have any full proof mechanism to stop piracy of the content and hacking of the accounts which causes loss of revenues. The company can enhance its customer base by launching more affordable plans. Also, you can read the PESTLE Analysis of Netflix to determine how the macroenvironment factors influence the company or the automotive industry.

Recommended Readings

References

Espósito, F. (2022). Apple TV+ market share grows in the US while Netflix loses ground to its competitors. 9to5mac.com. Retrieved 1 April 2022, from https://9to5mac.com/2022/01/24/apple-tv-market-share-grows-in-the-us-while-netflix-loses-ground-to-its-competitors/.

NASDAQ. (2019). Netflix Ranks as #1 in the Reputation Institute 2019 U.S. RepTrak 100 - the Biggest Ever Corporate Reputation Survey in the U.S.. www.nasdaq.com. Retrieved 1 April 2022, https://www.nasdaq.com/press-release/netflix-ranks-1-reputation-institute-2019-us-reptrak-100-biggest-ever-corporate

Perez, S. (2019). Netflix may be losing $192M per month from piracy, cord cutting study claims. techcrunch.com. Retrieved 1 April 2022, from https://techcrunch.com/2019/02/27/netflix-may-be-losing-192m-per-month-from-piracy-cord-cutting-study-claims/

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register