Nintendo Overview

Nintendo is a globally acclaimed and successful video game company headquartered in Japan. The company was incorporated in 1889 and its first product was called hanafuda cards. Nintendo’s operations are spread across different territories that include the whole of Americas, Asia Pacific, Europe, Middle East, and Africa. The countries it serves include the USA, Canada, Argentina, Japan, Australia, New Zealand, UK, France, and Russia among others (Nintendo, 2022). Moreover, it employs 6,574 personnel in its offices worldwide (Alsop, 2022). Nintendo’s revenue has grown by a significant margin over the years and its sales jumped from $4581 million in 2015 to $15,990 million in 2021 (Alsop, 2022).

Probing further, Nintendo’s mission statement is to provide the highest quality products and treat every customer with attention, consideration, and respect. This article offers an insight into the influence of external business factors on the company through an elucidated PESTLE Analysis. To explain, the PESTLE Analysis Model is a widely applied strategic analysis tool used by companies to keep pace with the changes in the macroenvironment.

So, let us get started with the analysis to assess the political, economic, social, technological, legal, and environmental factors affecting the gaming industry with respect to Japan and UK.

Table of Contents

Nintendo PESTLE Analysis: An In-depth check of facts

Political factors affecting Nintendo

The political instability in Japan has risen recently with frequent changes in leadership. There have been three presidents in the office during the last three years (Fodale, 2021). The frequent change in leadership can cause uncertainty in policymaking, thereby having a negative impact on the business. Further, the sanctions by the Japanese government on Russia can severely impact the shipment of gaming consoles and other entertainment devices, thus negatively impacting the financials of the entertainment industry.

Further, most of the chips used in the consoles of Japanese video game companies are sourced from the US, which is further dependent on Ukraine for procurement of green neon supplies and the ongoing war has disrupted the businesses and made it difficult for the companies to import the materials (Leswing, 2021). This would indirectly impact the manufacturing capacity of video gaming companies. In addition, the production facilities of most video game companies are located in China and the Japanese government is discouraging companies to shift their investments out of China (McFerran, 2020).

Though the government is providing subsidies for making a shift, the companies would have to spend a great number of resources on searching for land, establishing bases and making networks, etc. (Dooley and Inoue, 2020). On the other hand, the US has a politically stable environment, and the US Department of State in partnership with the non-profit organization Games for Change has announced a project to engage 2700 students in a virtual student exchange program wherein the students would be involved in development and creation of social impact of video games (Smith, 2021).

This can be positive news for the video game companies as they can partner in this program and enhance the brand image along with exploring new opportunities. Video game companies have to deal with different taxation policies as a result of international operations and the US, one of the major markets for the video game industry has reduced the corporate tax from 35% to 21%, thereby providing financial relief to the companies (PwC, 2022).

Also, the UK is another important market and the lower tax bracket of 19% can encourage video game companies to invest more in the UK market, hence increasing their prospects for financial gains (PwC, 2022).

Economic factors affecting Nintendo

According to OECD, the growth rate in Japan is expected to be 1.8% by the end of FY2021 and increase to 3.4% in 2022 and then further decrease to 1.1% in 2023 (OECD, 2021). The huge fluctuation in the growth rate would prevent consumers from spending on entertainment and saving more for their basic necessities, thus leading to a decrease in sales for the video gaming companies.

But the unemployment rate in Japan is consistent over the last 1 year at less than 2%, it was 2.9% in Feb 2021, 2.6% in March, 2.8% in Nov and 2.7% in December respectively, and is expected to be 2.5% by Q1 2022 and would stay the same by the end of 2023.

The low unemployment rate can be positive news for the video gaming companies as being employed means the residents would have a fixed source of income, thereby leading to an increase in their disposable income which ultimately would lead to an increase in the sales of the companies. The video gaming companies also ship a large batch of shipments to multiple countries, hence the sudden change in exchange rates can have an impact on the cost of the products.

In addition, the US, one of the major markets for the video gaming companies is expected to witness a sharp decline in the coming years from the current level of 5.7% in 2021 to 4% in 2022 and to 2% going in 2024 while another major market UK grew by 6.9% in 2021 and lower to 4.7% in 2022 (Partingon, 2022).

Alongside the growth level, the unemployment level is not expected to change much in the US, it was 3.9% in 2021 and is expected to be 3.5% in 2022 and would be at the same level in 2022 and 2023. The decline in growth rate and no significant improvement in the unemployment rate can lower the real income and purchasing power of people, thus negatively impacting the sales of the video game companies.

The video gaming industry in Japan is valued at 1.66 trillion Yen and is the third-largest video gaming market after China and US. Further, the Japanese gaming industry is expected to reach 1.9 trillion Yen by FY2027 (Statista, 2022).

Social factors affecting Nintendo

There are 15.03 million children in the age bracket of 0-14 years, thus accounting for 12% of the total population (Statistical Bureau of Japan, 2021). The high population of children can be a positive sign for the video gaming companies as the companies would have more markets to target, hence leading to an increase in the sales prospects of the video gaming companies. Further, people in Japan spend 16.9 hours on average per week playing video games and the individuals incurred $300 per person in the year 2021, signifying the scope for the video gaming companies (Bhushan, 2021).

But the evolving trend of mobile games wherein almost 71% of people play games on smartphones daily can act as a threat to the companies dealing in consoles and related gaming components (Nozaki, 2021). In the US, 30% of consumers pay for a gaming subscription service, and a huge number of people, 41% are actively involved in playing games, at least once a week. These favorable numbers pose an opportunity for video game companies to increase their market share and profits (Westcott and Loucks, 2019).

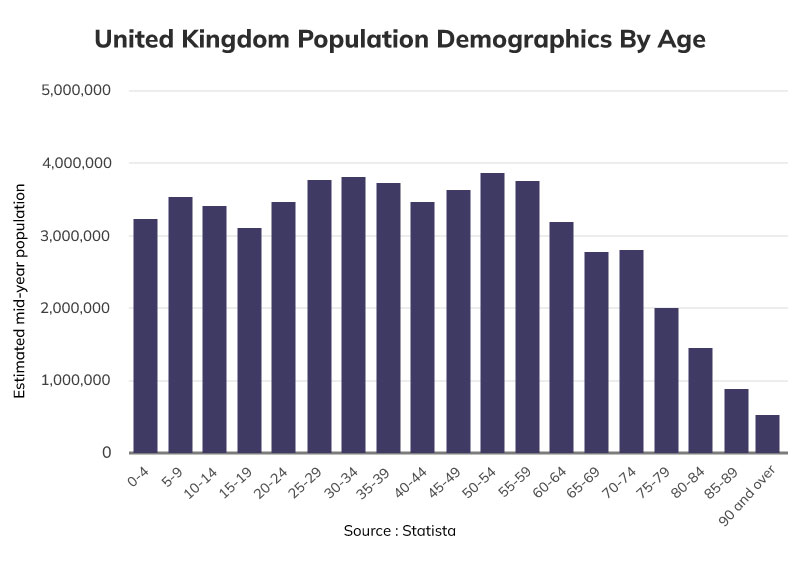

Furthermore, with respect to the United Kingdom, a large population of children and youngsters offer a great opportunity to the video game industry. The population demographics of the United Kingdom are represented by the graphic below.

Technological factors affecting Nintendo

The Japanese government spends hugely on Research & Development, in 2020 it spent more than 19.50 billion yen while US and UK governments also focus a lot on R&D with expenditures of $157 billion and 14.9 billion euros respectively in 2021 (UK Government, 2022). Further, various technologies have emerged in the video gaming industry that includes 3D graphics in the games for improving the quality.

Further, the existence of Virtual Reality has enhanced the consumer experience as it helps in creating a realistic image along with sound and other sensations to offer an imaginary setting that stimulates a gamer's physical presence in the environment. To exploit these technologies to the fullest, companies will need to work on effective change management strategies to stay ahead of their competitors.

Legal factors affecting Nintendo

The Fair Trade Maintenance Act restricts unfair business practices including monopolization, price discrimination, predatory pricing, forming cartels, and interference with a competitor’s transactions (Baker McKenzie, n.d.). These restrictions can impact the video gaming companies as they cannot create a monopoly or exploit the market by forming a cartel.

Further, the state of Yakuza passed a law that prohibits gaming companies from holding online contests (Nakamura and Taniguchi, 2017). This can have a negative impact on the financials of the gaming industry. In addition, the new ordinance by the state of Kagawa limits the time the children can play games for up to 60 minutes on weekdays and 90 minutes on weekends (Peppiatt, 2020).

This can reduce the number of transactions in the online gaming industry. Japan has a strong Intellectual Property system in place and the company can get their idea or technology patented for a period of 25 years, highlighting the positive scope for the companies involved in tech-related industries (Shirane, 2021).

Environmental factors affecting Nintendo

Electronic products produce about 650,000 tons of waste and produce a great number of fluorocarbons. The Japanese government has established targets of 70% for the recycling of fluorocarbons by the end of 2030 (Kanagawa and Nakayama, 2021). The high targets of recycling can put a financial burden on the companies as they would have to establish adequate infrastructure and research different ways of recycling the waste. Further, the e-waste rules in the UK state that the companies must provide a free in-store take-back service to the customers for the electronic products and must compulsorily recycle the products (UK Government, 2022).

This can increase the need for both human and financial resources for video game companies. In the US, 27 states have different e-waste regulations, for example, Indiana makes it mandatory for the companies dealing in video display devices to collect and recycle 60% by weight of the volume of products they sold in the previous year in Indiana.

If the companies fail to meet the targets in the first two years, then they would be liable to pay an additional recycling fee for every pound they fall short of their goal (McCrea, 2019).

Hence, it can be concluded that the Japanese have a huge craze for video games and it can be a perfect market for the video game companies seeking more markets or even Japanese video game companies can increase their market share. Many technologies, especially virtual reality is changing the way gamers play. However, the major problem relates to the generation of e-waste that results from the disposal of the scrapped products like consoles, and companies must find appropriate solutions to it, one of which can be creating a circular economy wherein instead of dumping, the scrapped product gets recycled and is brought to use in the economy.

Furthermore, to recognize the internal strengths and weaknesses of Nintendo and see how they can help the company exploit the available opportunities, you can read our well-researched SWOT analysis of Nintendo.

References

Bhushan,, R., & Habschmidt, T. (2021). Japan: Revenue-generating juggernaut. Retrieved 18 April 2022, from https://www.thinkwithgoogle.com/intl/en-apac/consumer-insights/consumer-trends/beyond-2021-gaming-industry-insights-trends-japan/

Leswing, K. (2021). Qualcomm jumps into hot gaming market with new chip for portable game consoles. Retrieved 18 April 2022, from https://www.cnbc.com/2021/12/01/qualcomm-introduces-new-chip-for-game-consoles.html

McCrea, B. (2019). The Evolution of E-Waste Laws and Regulations. Retrieved 18 April 2022, from https://www.sourcetoday.com/industries/article/21867326/the-evolution-of-ewaste-laws-and-regulations

Nakamura, Y., & Taniguch, T. (2017). Yakuza Laws Hold Back E-Sports Contests in Game-Obsessed Japan Read more at: https://www.bloombergquint.com/technology/yakuza-laws-hold-back-e-sports-contests-in-game-obsessed-japan

Copyright © BloombergQuint. Retrieved 18 April 2022, from https://www.bloombergquint.com/technology/yakuza-laws-hold-back-e-sports-contests-in-game-obsessed-japan

Peppiatt, D. (2020). Japan passes new law limiting gamers to one hour of play time per day. Retrieved 18 April 2022, from https://www.dailystar.co.uk/tech/gaming/japan-passes-new-law-limiting-21792335

PwC. (2021). Corporate - Taxes on corporate income. Retrieved 18 April 2022, from https://taxsummaries.pwc.com/united-kingdom/corporate/taxes-on-corporate-income#:~:text=The%20normal%20rate%20of%20corporation,The%20rate%20is%2010%25

Shirane, N. (2021). The Intellectual Property Review: Japan. Retrieved 18 April 2022, from https://thelawreviews.co.uk/title/the-intellectual-property-review/japan

Statistics Bureau of Japan. (2021). Statistical Handbook of Japan 2021. Retrieved 18 April 2022, from https://www.stat.go.jp/english/data/handbook/c0117.html

Tyler, D. (2021). 7 Trends Redefining Game Design: How Technology Is Changing the Gaming Industry. Retrieved 18 April 2022, from https://www.gamedesigning.org/gaming/advances-in-technology/

UK Government. (2022). BEIS research and development (R&D) budget allocations 2021 to 2022. Retrieved 18 April 2022, from https://www.gov.uk/government/publications/beis-research-and-development-rd-budget-allocations-2021-to-2022/beis-research-and-development-rd-budget-allocations-2021-to-2022

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register