Canada Overview

In terms of geographical area, Canada is the second-largest country in the world with a multicultural and multiethnic population. Besides, Canada is a prosperous and progressive country that offers a thriving environment for trade and commerce activities. However, it is also true that Canada was one of the worst affected nations by the COVID-19 pandemic and businesses suffered major losses due to lockdowns and various restrictions.

For business organizations based in Canada or those looking to expand to Canada, it becomes essential to analyze the macro business environment in Canada. Subject to the current state of political, economic, social, technological, legal, and environmental scenarios in Canada, industries will have to work on various change management strategies to succeed.

Having said that, this article presents a delineated and extensively conducted PESTLE Analysis of Canada to analyze the business environment in the country. The article delves deep into the overall business environment in the country to determine how it is favorable or unfavorable for some industries.

Table of Contents

A Precise PESTLE Analysis of Canada

Political factors affecting different industries in Canada

Canada can be considered a highly stabilized country as the same administration has been in power for last so many years and there have not been any frequent changes in laws that can have a severe impact on the businesses. Further, the industries can benefit in Canada from the fact that Canada has free trade agreements with its neighbors under USMCA which was earlier known as NAFTA.

The USMCA can help the small-scale industry of Canada, especially the companies that are not financially sound as the companies now do not require to have a physical presence in the US or Mexico if they want to export their goods to these respective countries.

Further, the agreement can benefit the companies financially as, under the new agreement, the Canadian government now does not impose any duties for orders below $150. This can help the companies that would sell their products directly to customers, for example through e-commerce. The elimination of duties would mean no additional increase in expenditure, hence the companies would be able to maintain stability in the prices of the products and hence their shipment levels would rise.

Furthermore, the companies can benefit from the fact that the protection for industrial designs under the USMCA has been extended to a period of 15 years as compared to 10 years earlier (Enright, 2021). In addition, the Alberta government has approved a reduction in the corporate tax rate from 12% to 8%. This can be beneficial for the companies as they would be able to save on the liquidity and the province would also witness more investments (Enache, 2020).

Moreover, the Canadian government offers rebates to the people to the tune of $5000 on the purchase of electric vehicles. This can be positive news for the automotive companies that are experts or looking to venture into the manufacturing of EVs as their sales would rise because of more affordability among the customers as a result of incentives (Little & Chernecki, 2022). However, the construction and housing companies can suffer a blow from the government’s recent decision involving a temporary ban on foreigners from purchasing homes in Canada (Platt & Altsteder, 2022). Moreover, the province of Saskatchewan has amended the property tax rules and now the evaluation will be done at 85% instead of 100%, thereby leading to 15% savings for the retailers.

Despite the positive environment, there are a few industries like the dairy industry that are being overlooked by the government. The signing of the USMCA would provide the US dairy farmers an open market to trade in Canada which was currently restricted to Canadian farmers and this is expected to cost the dairy industry dearly, around $100 million (McCarten, 2020). To add to the worries, the Canadian government does not provide any financial assistance to the dairy industry which can lead to more increase in their business and losses.

Also, the banking and life insurance companies would have to face difficulties as the government has launched a temporary Canada Recovery Dividend wherein the banking and life insurance companies would be mandatorily required to pay a one-time 15% tax on income above $1 billion for FY2021 and also the corporate income tax rate has been raised by 1.5% from FY2022 for banking and life insurance companies. Therefore, this decision would lead to an additional financial burden for the companies (Government of Canada, 2022).

Further, in terms of foreign relations, Canada has severed its ties with Russia and has imposed various sanctions on Russia in the wake of the Russia-Ukraine conflict. This could have a negative impact on Canadian firms that had considerable market shares in Russia. Besides, with other countries of the world, Canada has flourishing trade and commerce relations. For instance, as per the official website of the Canadian government, India being an emerging market is the 11th largest export market for Canada. Also, the two nations have progressive plans to further deepen their trade ties.

Economic factors affecting different industries in Canada

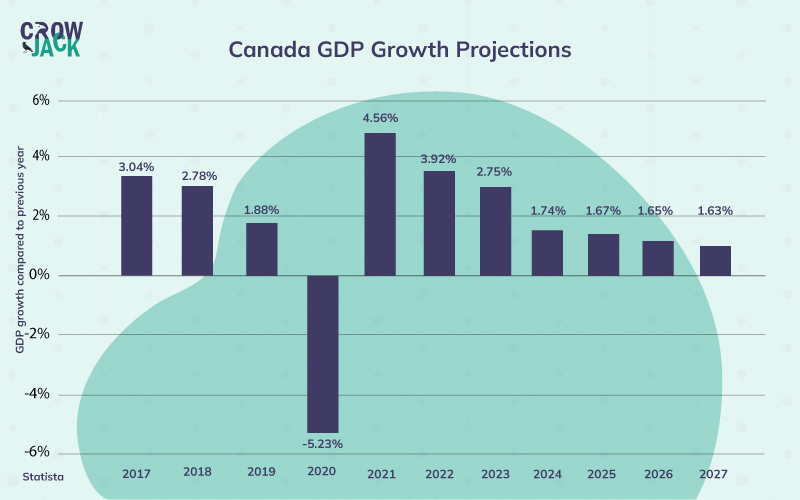

Canada is one of the top 50 economies of the world. The economy of Canada is currently in a good state and the country registered a growth of 6.7% in 2021 (CBC, 2021). But this growth is not expected to hold on much longer and it is predicted that the country’s growth would witness a downfall in 2022 wherein it would grow by 3.8%. Further, the unemployment in Canada is not expected to change much and maintain the levels of 5.6% in 2023 and 5.5% in 2024 as compared to the current unemployment level of 5.5%. The decline in growth rate and employment would have an impact on the revenues of the industries dealing in non-essential items like automobiles, housing, consumer electronics, etc. The GDP growth projections for Canada are presented in the illustration below.

But, the industries related to the selling of grocery items and other important household products would continue to grow stably. The retail and other industries such as QSR mostly operate through franchisee based models and the franchisors do not own the stores but rather rent or lease them so the change in the rentals have a great impact on these industries and in the last two quarters, the rental rates have declined in Canada by 0.5% and 0.6% respectively, this can lower the cost of the operations of the companies.

Furthermore, industries such as automobiles and other industrial goods get impacted by the change in the interest rates as most of the customers finance the expensive products and the Bank of Canada has announced its plans to raise the base rate by 0.5%, which would increase the cost of borrowing for the customers and therefore the industries would see a decline in the demand for the goods.

In Canada, the consumer prices increased by 5.7% which is above the moderate level and this can be a barrier for the companies dealing in affordable goods as the prices of input would rise which would ultimately harm the prices of the final products and this would reduce the affordability for the customers, hence would lead to decrease in the sales of the companies. On the other hand, the industries that deal in luxury products would not have to worry much as their target market is wealthy individuals who do not care about the price of the products but rather their status symbol.

In addition, the emergence of COVID saw the 100% seizure of businesses in a few industries like aviation, aerospace, and hospitality. The civil aviation industry in Canada registered a decline in operating income by $5.1 billion and likewise, the occupancy rates in the hotels were below 20%, reflecting huge unused inventory. Now that the COVID pandemic has almost settled, these industries would look to bounce back and reclaim their pre-pandemic success.

Social factors affecting different industries in Canada

The social culture of Canada is a perfect amalgamation of various cultural dimensions. The trend of fitness and sustainable consumption is increasing in Canada. More than 1.4 million people in the country have shifted to plant-based meals. This can pose a threat to many industries like the poultry industry, dairy, and QSR and they might see a huge decline in their businesses. However, the QSR industry can exploit the opportunity of entering into new markets and increasing its financial stability. The e-commerce business in Canada can witness a huge surge in business as more than 45% of people would prefer ordering the food online whereas 59% of people have started ordering more grocery and consumer goods through e-commerce platforms.

Furthermore, the trend of sustainability is also on the rise and 47% of people in Canada prefer buying natural products and 29% prefer to buy organic products. This trend signifies the need for the food, cosmetics, and other related industries that use harmful chemicals in their products to shift to sustainable products.

In addition, the literacy rate in Canada is above 60% and the majority of the population is at least a school graduate which is a positive sign for tech-enabled companies like IT solutions, companies dealing in smart wearables, etc. as more literacy rate means the people would be more equipped with the knowledge to operate digital products. Moreover, around four million employees in Canada are still working from home and this trend would increase the demand for different gadgets which would be beneficial for the electronics companies (Nixon, 2021).

The trend of purchasing residential properties in Canada has increased by a great margin and this trend has led to a great increase in the prices of properties. Hence, it can be a perfect chance for the housing, construction, and allied companies to increase their sales. Thus, the real estate sector is expected to experience high growth in Canada in the coming years.

With the increase in the demand for housing, there would be a positive impact on the demand for various home furnishing products as well, thus this would indirectly benefit the companies dealing in home furnishing products as well. Also, the companies dealing in luxury goods stand a good chance of being profitable as the high net worth individuals in the country are expected to 335,800 net worth individuals and they are predicted to grow by 50% to 503,800 by 2026 from the current number of 335,800.

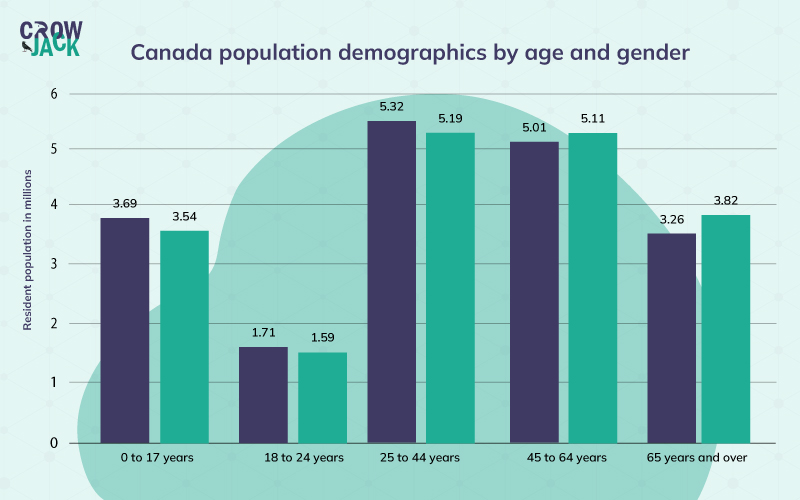

Furthermore, the population demographics of Canada by age and gender are illustrated below

Lastly, the proportion of private consumption in canada is quite high at 54.6 percent. This is a positive sign for businesses in Canada as they have a large domestic market to cater to.

Technological factors affecting different industries in Canada

As per The Conference Board of Canada, the country’s spending on business research and development was USD 15.6 billion which accounts for 51 percent of the total R&D expenditures. Hence, the government in Canada is keen on investing large sums of public money in business R&D which will enable greater efficiency across industries and greater scope for integrating technologies.

Canadian businesses can benefit from emerging technologies like Big Data Analytics, Blockchain, Augmented Reality, Virtual Reality, 3D printing, artificial intelligence, etc. Big Data analytics works based on analyzing the past and present data and is used to forecast the demand for the future so that the companies can produce and stock up appropriately. Further, this technology also helps the companies in knowing what product is currently in demand. This can help the companies accurately forecast the demand and reduce wastage with effective change management.

3D printing is used to manufacture the products through the use of technology rather than manually. The products can be manufactured more quickly and the resultant product is more accurate. This technology is being heavily used by the automobile industry to manufacture spare parts and the housing industry uses it to design the whole house. Virtual Reality can be a great means to let people experience the realities without physically doing the tasks. For example, many businesses use it for the training purpose wherein the employees are trained off the site and made aware of the real situations that the employees would be working in. Even the entertainment industry uses virtual reality to present the scenes more closely.

Furthermore, artificial intelligence in the form of chatbots to interact with the customers 24*7 and robots for doing various human tasks are gaining importance (Forbes, 2020). Moreover, the automotive industry is experimenting with various technologies like solar-powered vehicles and faster batteries for the EVs that could charge the vehicle in under 15 minutes. Novel EV technologies are emerging in the automotive industry that can be a great boost for Canada-based car manufacturers.

Legal factors affecting different industries in Canada

Canada has the competition bureau that is responsible for enforcing the anti competitive laws, packaging and labeling laws and marking of precious metals. The main aim of the bureau is to protect consumers from unfair trade practices. According to the competition act, the companies cannot indulge in agreements or mergers to eliminate the competition and the marketplaces should function in a fair manner. The federal government of Canada has recently amended the Income Tax Act wherein the transfer of the family businesses to children would now be treated as long-term capital gains instead of dividends. This would make the businesses eligible for the tax exemptions on the long-term capital gains. The industries that would benefit from this reliance include family farms, fishing corporations, and “small business corporations'' (Jarvis, 2022).

Further, the social media giants like Facebook and other IT companies such as Google would have to adjust their revenues in the future as the federal government has passed a law wherein the social media companies would have to share the part of the revenues earned while streaming the news or sharing the link of physical media outlet. This would lead to an increase in the revenues for the media outlets and the social media channels would shy away from sharing someone else’s content.

Furthermore, the companies would now not be able to track their employees freely as the Ontario government is planning to introduce a new law wherein the companies would have to inform the employees whenever they would be tracked (CBC, 2022). Moreover, the companies in industries such as retail and others that save customer data and market them would now be required to obtain the consent of the customers before sending them messages as the federal government has introduced an Anti-Spam Law wherein it has been made illegal for the companies and they would be fined if found to be indulging in the illegal practice. This would make marketing more difficult for the companies. The other major laws that impact businesses relate to employment.

The federal government has introduced the provision of various leaves for the employees that include leaving for the employees suffering from domestic violence of up to 10 days and leave for indigenous practices of up to 5 days along with the personal leave of up to 5 days. In addition, the employees are entitled to 3 weeks of paid annual vacation after 5 years of service and they are provided with more flexibility wherein the employees can now take a vacation in more than one period (Government of Canada, 2022). Moreover, there has been an increase in minimum wages in many provinces including Ontario, British Columbia, Nova Scotia, and New Brunswick, and the pay raise can lead to an increase in the expenses for the companies.

Environment factors affecting different industries in Canada

The top most polluting industries of Canada include Oil & Gas, transportation, retail sector, delivery companies, agriculture, meat & dairy, etc. These industries pollute the environment through the excessive use of energy, and water and release of emissions by using unsustainable fuel for their operations. Further, many industries also use plastic for packaging their products. These industries can face challenging times ahead as with the government’s shift of attention toward a carbon-free economy, the industries would have to look for alternate ways of conducting their business operations.

The Canadian government has passed a Net Zero Emissions Accountability Act wherein it aims to have a carbon neutrality economy by 2050. This would have a significant impact on the industries that produce high emissions. Also, the government is banning single-use plastic and the companies would have to use paper or cardboard packaging which might increase the cost. Moreover, the federal government has announced the banning of all gasoline vehicles from 2035 which means that auto companies would have to sustainable options like hydrogen or electric which can prove to be fruitful for them as the delivery companies would also be required to change their fleet for which they would purchase new sustainable vehicles and this would lead to increase in the sales for the automobile companies.

To encapsulate, Canada is a strong and peaceful economy wherein the businesses are flourishing at a faster pace. The current political scenario wherein Canada has FTA with US and Mexico can benefit the companies as they can easily ship their goods to these two nations. The luxury goods industry can benefit while operating in the Canadian market as the high net worth individuals are poised to grow in the future and also there is a huge trend of people working from home, signifying a positive opportunity for the electronics and software industry. The companies can take advantage of many emerging technologies in the market. The industries that pollute the environment need to be varied as the government is enforcing stringent norms for eliminating carbon emissions.

Recommended Readings

References

CBC. (2022). Ontario proposing new law that would require businesses to tell staff how they're being tracked online. www.cbc.ca. Retrieved 9 April 2022, from https://www.cbc.ca/news/canada/toronto/ontario-employee-electronic-surveillance-1.6362521.

Deloitte. (2021). Canada’s Anti-Spam Law (CASL) FAQ. ww2.deloitte.com. Retrieved 9 April 2022, from https://www2.deloitte.com/ca/en/pages/risk/articles/canada-anti-spam-law-casl-faq.html.

Enright, M. (2021). The Benefits of New NAFTA (USMCA) for Small Businesses. www.wolterskluwer.com/. Retrieved 9 April 2022, from https://www.wolterskluwer.com/en/expert-insights/the-benefits-of-new-nafta-usmca-for-small-businesses.

Forbes. (2020). 15 Emerging Technologies That Will Change The Future Of Business Development. www.forbes.com. Retrieved 9 April 2022, from https://www.forbes.com/sites/forbesbusinessdevelopmentcouncil/2020/12/07/15-emerging-technologies-that-will-change-the-future-of-business-development/?sh=7f42ee00323b.

Government of Canada,. (2022). Labour Program: Changes to the Canada Labour Code and other acts to better protect workplaces. www.canada.ca. Retrieved 9 April 2022, from https://www.canada.ca/en/employment-social-development/programs/laws-regulations/labour/current-future-legislative.html.

Government of Canada. (2022). Tax Fairness and Effective Government. budget.gc.ca/. Retrieved 9 April 2022, from https://budget.gc.ca/2022/report-rapport/chap9-en.html.

Jarvis, C. (2022). New law means significant tax relief when you pass your business on to your kids. financialpost.com. Retrieved 9 April 2022, from https://financialpost.com/moneywise-pro/new-law-means-significant-tax-relief-when-you-pass-your-business-on-to-your-kids.

Nixon, G. (2021). Widespread working from home will end at some point, won't it? Maybe not. www.cbc.ca. Retrieved 9 April 2022, from https://www.cbc.ca/news/business/work-from-home-covid19-future-workers-wfh-1.6244944.

Platt, B., & Altstedter, A. (2022). Canada has a plan to curb soaring house prices: ban foreigners from buying homes. fortune.com. Retrieved 9 April 2022, from https://fortune.com/2022/04/07/canada-trudeau-plan-curb-house-prices-ban-foreigners-buying-homes/.

Statistics Canada. (2020). Annual civil aviation statistics, 2020. www150.statcan.gc.ca/. Retrieved 9 April 2022, from https://www150.statcan.gc.ca/n1/daily-quotidien/220121/dq220121d-eng.htm.

Toneguzzi, M. (2021). Canadians to Continue Shopping Online Post-Pandemic Amid Ecomm Growth. /retail-insider.com. Retrieved 9 April 2022, from https://retail-insider.com/retail-insider/2021/07/canadians-to-continue-shopping-online-post-pandemic-amid-ecomm-growth-survey/.

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register