Introduction

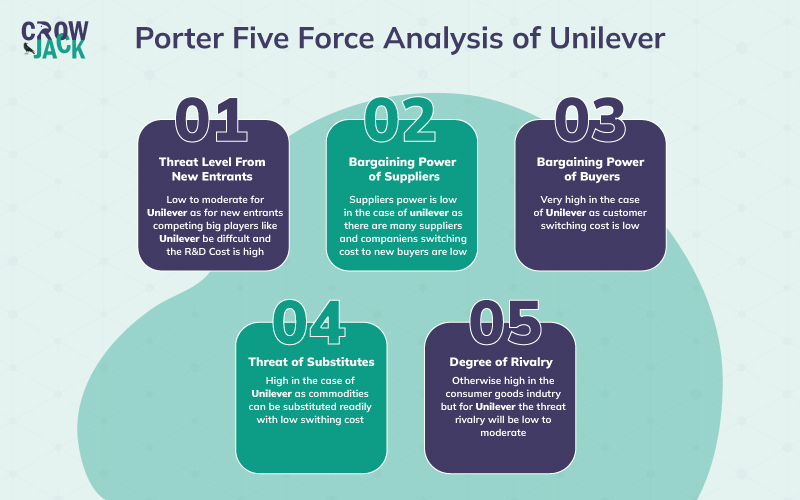

The Porter Five Forces Model for company analysis is a widely applied strategic planning tool that is utilized by organizations to evaluate the competitive structure of an industry. This analysis delves into the competitive structure within an industry based on the following five parameters.

- Barriers to entry of new entrants

- Bargaining power of suppliers

- Bargaining power of buyers

- Degree of rivalry in the industry

- The threat of substitutes

An effective competitive analysis based on these parameters will help organizations realize the industry’s competitive environment in an efficient manner. For organizations, the Five Forces Analysis is a key methodology to evaluate their competitive strength and positioning. Moreover, subject to the inferences from this analysis, organizations can effectively plan their future strategies and objectives to optimize their competitive positioning in the industry through effective change management.

Further, to create a better understanding of the application of the strategic planning model, we have applied it to analyze the competitive positioning of Unilever Global. So, let us get started without further ado.

Unilever Five Forces Analysis To Analyze Competitive Position

| Porter 5 Forces Analysis | Threat Level | Description |

|---|---|---|

| Barriers to entry and new entry threats | Low to moderate | Customer switching cost in the consumer goods and retail industry is low and also consumers are now more engaged in digital channels of purchase and hence the entry of new startups/firms becomes much easier in the virtual e-commerce environment. Also, the government in the UK has launched new strategies to give a major boost to the consumer and retail industry in the UK by setting up a Consumer and Retail Export Academy which will encourage the emergence of new players in the consumer goods and retail industry. In the digital purchase environment, even the starting costs will be much lower for new entrants. Setting up brick and mortar stores or corporate offices will be costly for new entrants but the digital environment will help them in averting these costs. However, new entrants will also need to invest heavily in R&D for consumer products which will involve high costs, and for new entrants, it will be difficult to directly pose a big threat to big companies in the industry like Unilever and Nestle. |

| Bargaining Power of Buyers | High | The buyer bargaining power is high in the consumer goods industry as consumers have endless options when it comes to commodities and the switching cost for consumers in the consumer goods industry is also low. If any company in the industry including Unilever hikes prices in an unprecedented way or deteriorates the quality or safety of the products then there is a high risk of consumers switching to other alternatives. Also, the consumers in the United Kingdom are literate and educated enough to compare the different alternatives available to them. |

| Bargaining Power of Suppliers | Moderate | The bargaining power of suppliers in the consumer goods industry is moderate because there exists a good number of suppliers across all verticals of consumer goods. However, in the ongoing supply chain crisis, the suppliers can assume greater power by exploiting supplies or hoarding supplies deliberately. Besides, for big players like Unilever, the influence of companies will be greater than those of the suppliers. For the companies in the industry, the cost of switching to new suppliers is low which prevents the suppliers from assuming enormous bargaining power. Besides, small suppliers in the consumer goods industry directly rely on the industry as the largest source of revenue. |

| Threat of substitutes | Very High | In the consumer goods industry that majorly deals in commodities, consumers have countless alternatives to choose from, and hence the risk of substitutes is enormously high. In the context of Unilever specifically, for every segment of its products, a large number of substitutes are available whether it is in personal care, food, hygiene, supplements, etc. Lastly, for the customers, the switching costs are negligible because they will most likely find products of Unilever and its competitors at the same e-commerce platform or in the same supermarket. The products in the industry are largely homogenous and there is perfect competition in the industry where all competitors are equally poised. |

| Degree of Rivalry | High | In the consumer goods industry there are some well-established names and new local firms are emerging at a fast pace and winning the trust of consumers. For the new firms emerging in the market, the strategic stakes are very high. Also, in the consumer goods industry, the scope for product differentiation is limited. Rivalry is increasing both in the physical market and the e-commerce market and also because of the after-effects of the COVID-19 pandemic the growth rate has been impacted. Unilever faces direct competition from Johnson and Johnson, Nestle, Procter & Gamble, GSK, and so on, all of them being big players in the consumer goods industry. Also, new players can bring a strong digital presence in less time with influencer marketing, SEO, and aggressive social media marketing. Also, the demand for consumer goods is ever-growing. Local brands emerging in the consumer goods industry are giving stiff competition to big industry players. However, Unilever has a 58 percent turnover rate in emerging markets and for rivals, challenging the authority of Unilever will be challenging. |

Recommended Readings

Proof Reading

Proof Reading  Copy Writing

Copy Writing  Resume Writing

Resume Writing  Blogs

Blogs Guides

Guides SOP's

SOP's Student Resources

Student Resources Research Topics

Research Topics Login

Login Register

Register